As the popularity of forex soars, so too do the number of different ways you can trade or invest it.

By now, you’ve probably heard most of those ways. But over the last couple of years, a new one has come up that removes many of the trading ‘annoyances’ and brings some major benefits…

CFD Trading.

Today’s post is a guide on how to get started with CFD trading.

I’ll begin by going over what CFD trading is and how it differs to trading through a normal forex site. After that, I’ll detail what website to trade on and show you how to buy, sell, and set stop loss orders. And then at the end, I’ll go over a couple of important things to know about CFD trading.

With that, let’s get started.

Note: CFD trading is only available to people in the UK and some parts of Europe. It’s not available in the US or China due to laws put in place by the government.

CFD Trading Is The Same As Normal Trading

Surprising, isn’t it?

Okay, so it isn’t exactly the same; I’ll get to the few differences in a minute. But for the most part buying, selling, and placing CFD orders, is identical to how it is done when you trade forex normally.

So, what are the differences?

Well, there are a couple of minor ones, but they are very important.

Before we get to those, however, let me quickly explain what CFD trading is all about.

CFDs are Contracts for Differences, and CFD trading is based on buying and selling CFD contracts.

I won’t bore you with the details how they work (it’s not necessary to know anyway), but a CFD is a type of virtual asset whose price is derived from a real asset. (So a EUR/USD CFD is the exact same price as the EUR/USD currency pair) It is not, however, the actual asset.

Now, that last part, “is not the actual asset” is really important and actually brings me on to the first big difference between CFD trading…

Ownership.

Because it’s a derivative, a CFD is not the actual currency pair.

While that may not sound good, in the context of CFD trading, it has significant benefits.

For example:

In normal trading, you make money when you sell after a rise in price. A CFD contract allows you to profit even if price falls.

But that isn’t the only difference.

Since it’s a derivative, it takes only a small amount of money to open an account – not bad if you’re strapped for cash.

And that’s pretty much it.

Sure, some minor differences exist, like how the trading platforms work, and understanding that some terms are different. But overall, these are the only real differences between CFD trading and normal forex trading.

Pretty cool, huh?

Choosing The Right CFD Broker

As with most trading and investing, CFD trades go through websites – brokers they’re called.

Brokers function just like exchanges: you can buy and sell CFDs, set stoploss orders, look at price charts, monitor open positions… basically everything you do on an exchange.

Finding a broker is easy; choosing one, however, is a bit more difficult.

Luckily, I have one in mind!

Plus 500.

Plus 500 is a broker I have used, and was actually one of the first to offer forex CFDs.

Plus 500 works like most brokers, but it’s undoubtedly the most beginner-friendly firm out there. That includes its easy-to-use trading platform, and its buying-and-selling options.

You shouldn’t have much trouble working with Plus 500. It is super simple to use, including setting stop losses. Everything is clearly labelled, making it easy to know what to do.

With that said, some people may have trouble, so here’s a quick guide anyway.

Placing A Trade Or Making An Investment

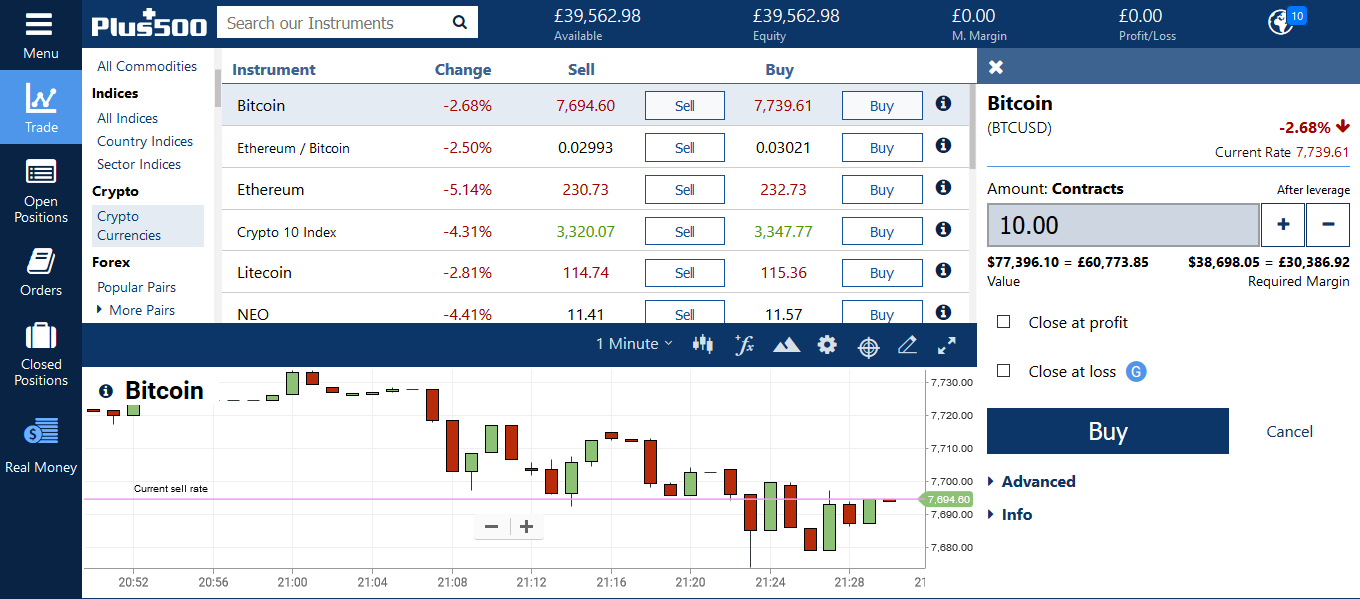

To place a trade on Plus 500, click either the “Sell” button to go short or the “Buy” button to go long. Both are next to each CFD label.

When you click on an option, a little menu tab will open on the right.

This menu lets you set the conditions of the trade, like how much you want to buy or sell, whether you want to do that now or at a specified price, and if you want a stop loss.

Here’s a guide to each option:

Contracts

Here, size matters. In CFD trading the more contracts you buy, the more money you’ll make if the price rises, and, of course, the more you’ll lose if it falls.

Always check the “Required Margin” before you place a trade. This is how much money must be in your account to keep the trade open.

If your account balance drops below this amount, Plus 500 will close the trade automatically regardless of whether it’s at a profit or loss.

Close At Profit

Close At Profit lets you select a price where a profitable trade will close automatically. Essentially, it’s a take profit order.

This is useful for ensuring you make a predetermined profit when you think the price could move in the opposite direction, but you won’t be around to close it manually. For example, if you think price will fall when it hits a resistance level whilst you are asleep.

Note: You can also set a “Close At Profit” price after you enter a trade. There is no additional fee for this.

Close At Loss

This is Plus 500’s version of a stop-loss order. It lets you set a price that limits your loss.

Stop losses are extremely important in trading. Make sure you always use one.

Guaranteed Stop

This is a type of stop-loss that’s guaranteed to execute.

There’s no need to use this, so just leave it unselected.

Closing A Trade

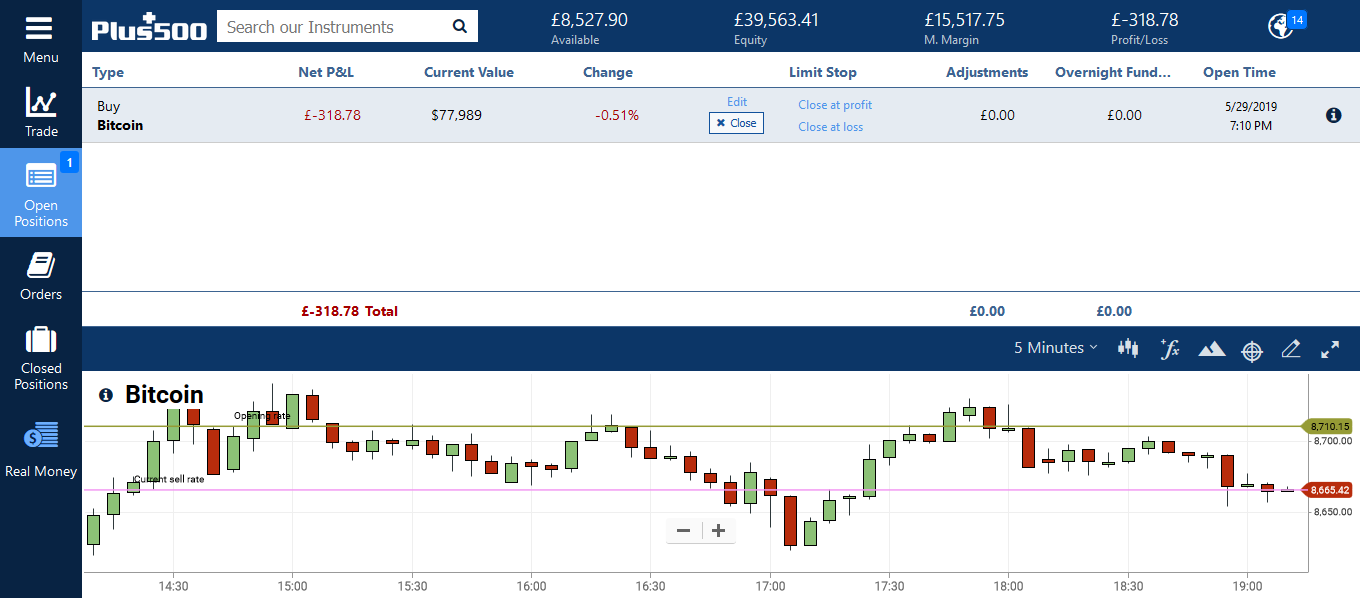

To close a trade, whether it’s at a profit or loss, click the “Open Orders” tab on the far left side of the trading window.

The tab shows all your open trades along with key information such as their current profit or loss, the stop loss prices, and the current price.

To close your position just click the “Close” button.

If you want to change the position in some way, like set a take-profit order or move the stop-loss price, click the “Edit” button and select the relevant option in the menu.

Two Important Points To Remember

We’re nearly at the end now, but before I close, here are a couple of important points to remember about trading CFDs:

Don’t Day Trade CFDs

It seems like everyone and their grandma wants to day trade these days – and who can blame them?

But while day trading is a great way to make money through a normal broker, doing so through a CFD broker is not a good idea. And it’s for one simple reason:

The spread.

In CFD trading, the spread – the price you have to pay to buy or sell – is much, much higher than it is trading through a normal broker.

This isn’t a problem if you only want to place a few trades, such as if you were swing trading or investing. But if you plan to buy and sell frequently, it’s a huge issue. Because it means you’ll have to make a lot more money to compensate for what you’ve lost on the spread.

For this reason, it’s best not to day trade CFDs.

If you want to day trade, do it through a proper normal forex broker where the spread is low.

Make Sure You Trade A Small Amount And Always Use A Stop Loss

If you do decide to start trading or investing in CFDs, make sure you start off small. And use your good judgement.

CFD trading might not be all that different from how we normally trade, but it doesn’t mean you should jump in enthusiastically without some experience.

Start by trading just a small amount. This will give you a feel for how things work. Then, once you’ve gained some experience and have a good idea of how to monitor trades, place different orders and use all of the other features of your chosen broker. Slowly increase your buy- and sell orders until you are making more money.

Simple!

Summary

CFD trading is a great alternative to normal forex trading, and I recommend anyone who has the chance to give it a try or at the very least check it out.