Position Size Calculator (How-To!)

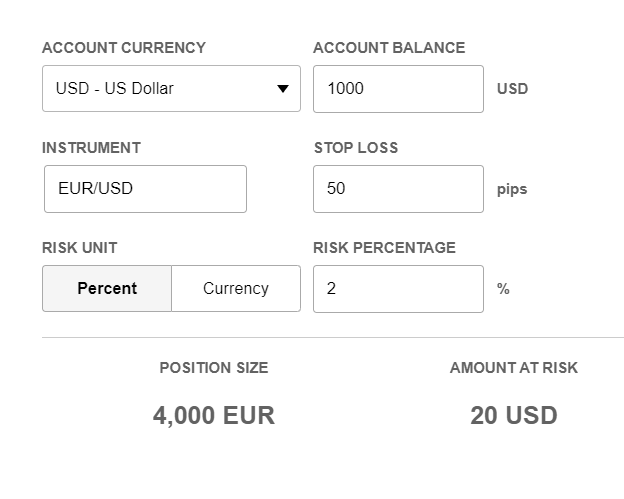

Calculate the optimal position size for every trade and protect your capital! This calculator determines how much to risk based on your account size, stop-loss placement, and desired risk percentage. Simply enter your details and click “Calculate” to see your ideal risk amount and corresponding lot size.

Note: Gold and silver are currently not supported due to variations in pip values across brokers.

Calculate Your Ideal Position Size in 5 Easy Steps

Managing risk is crucial for any trader, and position size is one of the few things we have complete control over. This position size calculator simplifies this process, allowing you to quickly determine the optimal trade size to protect your capital.

How to Use the Calculator:

Account Currency: Select the currency of your trading account.

Currency Pair: Choose the pair you plan to trade.

Account Balance: Enter the current balance of your trading account.

Risk Percentage: Specify the percentage of your account you’re willing to risk.

Stop Loss: Enter the size of your stop loss in pips.

Click “Calculate” and the tool will display your ideal risk amount and the corresponding lot size for various scenarios.

Understanding Position Size And Why It’s So Important

Position sizing is the cornerstone of sound risk management – a critical tool for protecting your capital while maximizing your profit potential. In the unpredictable world of forex, it’s one of the few aspects you have complete control over.

Think of position size as the “volume knob” of your trades.

It determines how much you’re risking on each position, directly influencing both your potential profits and losses. It’s a delicate balance – trade too large, and a single loss can cripple your account; trade too small, and you might miss out on significant gains.

Why Position Size Matters

Position size affects several key aspects of your trading:

Profit Potential: Larger positions can lead to bigger profits, but they also carry greater risk.

Loss Mitigation: Proper position sizing ensures that even when trades go south, losses remain manageable.

Stop Loss Placement: Position size directly influences stop-loss placement, defining risk for each trade.

Understanding position sizing is essential for long-term success . By calculating the appropriate trade size for your account balance and risk appetite, you can minimize losses and generate consistent profits.

Calculating Position Size

Calculating the right position size is crucial for effective risk management, ensuring you safeguard your capital and maximize potential gains.

Three interconnected factors determine the ideal position size:

Account Size: The Foundation

The amount of money in your trading account is fundamental to position sizing. A larger account allows for bigger trades, but don’t fall into the trap of oversizing just because you can. Always use a calculator to find the optimal size relative to your account balance, ensuring you never risk more than necessary.

Risk Tolerance: The Personal Touch

Your risk tolerance is the maximum loss you’re comfortable with on any single trade. It’s influenced by your account size, which in turn is affected by your position size – everything’s connected!

While risk tolerance varies, risking 1-2% of your account per trade is a common guideline. This safeguards you against blowing your account, even during a losing streak. On higher timeframes like the daily chart, risking 3-4% might be acceptable due to fewer trades, but it’s generally wise to err on the side of caution.

Stop Loss:

The Safety Net The distance between your entry price and your stop-loss is another critical factor in position sizing. Strategies with tight stops allow for larger positions, as the potential loss is smaller. Conversely, strategies with wider stops, often used on higher timeframes, require smaller positions to manage risk effectively.

Remember:

These three factors work together to determine the optimal position size for each trade. By understanding their interplay and using a position size calculator, you can confidently navigate the markets, minimize losses, and set yourself up for long-term success.