Sound familiar?

You place a perfectly good sell trade, stop loss just above the recent high.

Then, bam!

Price rockets higher, triggers your stop, and then… calmly reverses back in the direction you originally predicted.

Frustrating, right?

It’s easy to chalk these instances up to bad luck, but the truth is, there’s a reason this happens.

It’s called stop hunting.

A manipulative tactic used by the smart money to get trades filled, stop hunting is a common occurrence in forex. You’ve probably been on the losing end of it more times than you’d like to admit.

But here’s the good news:

You can turn this sneaky trick to your advantage. With a simple, free tool, you can learn to spot stop hunts and use them to set up profitable trades.

Intrigued?

Keep reading to discover how…

What Is A Stop Hunt And Why Do They Take Place?

Even though stop hunts happen all the time in forex, not many traders know what they are or the inner workings of why they take place.

For this reason, here’s a quick guide.

So to understand stop hunts, we need to talk about the big players…

Forex is dominated by large entries. Everyone from Banks, hedge funds to asset management companies are all active in the market, either to make money for themselves or for other people.

These big players control the market.

They decide when trends begin and end, and when consolidations and retracements take place. Every major event that happens in the market is started by them, and they work together to cause these events to occur.

Now here’s the important bit…

Everyone that’s active in Forex, from the banks and hedge fund to retail traders like you and me, cannot buy or sell unless other traders are buying or selling AT THE SAME TIME.

If people aren’t selling when you want to buy, guess what….you can’t buy.

If someone isn’t buying when you want to sell, you can’t sell.

But that’s not all…

Not only must other people be buying or selling at the same time as you, they also need to be buying/selling at either the same amount or higher.

This probably doesn’t sound very important, but the implications it has are massive…

Us retail traders don’t buy and sell in big amounts.

So we never have to think about whether enough people are buying or selling at the same time – and at the same amount – for us to get our trades placed.

For the big players, however, this isn’t the case…

Because they buy and sell in such huge amounts, the big players have to come up with ways to manipulate the market, to get enough people to buy and sell in the right quantities so that they themselves can place their own positions.

One of the main ways they manipulate it is via stop hunting.

Stop hunting is where the banks and other big players deliberately manipulate the price into a large bunch of stop orders placed by retail traders/investors to get their own positions placed at a favorable price.

It happens like this…

A bunch of stop orders will accumulate at some price in the market (usually a round number).

The banks can see where all the orders are placed. So when they see that a big bunch have built up they know it presents an opportunity for them to get their trades executed at a favorable price all in one go – rather than in bits, which is how they often have to place them.

By working together with market markers, the big players manipulate the price into the stop orders (normally via a quick, price spike) to execute them and get their positions placed.

The second the price hits the stops they trigger and become buy or sell orders.

The banks and other big players then use this influx of orders to place their own positions and the price then either rises or falls based on whether they bought or sold.

And that it.

That’s what a stop hunt is.

Now lets look at how you trade it…

How To Find Stops Using Oanda’s Order Book

Using Stop hunts as a setup or strategy would be really popular, were it not for one thing…

No-one knows (for sure) where the stops are.

Unlike the banks and other big players who have tools that allow them to see when and where people have placed their stop orders (and normal buy and sell orders) us retail traders have nothing…the best we can do is guess.

Or at least, we could until now…

While no official order book exists for us in forex there is a tool that can be used as a substitute:

A free tool provided by Oanda – one of the biggest forex brokers, the order book lets you see where all the traders and investors using Oanda have open buy and sell orders.

Even though it’s more basic than the order books banks and other smart money players have access to, Oanda’s Order Book does still provide a wealth of information, including where people have placed their stop orders, which is what we’re going to use it for.

How To Find Stops On The Order Book

The order book gives A LOT of information; it show us where people have placed their buy and sell orders as well as how many have been placed at a specific price.

But there’s one thing it doesn’t tell us that’s critical to trading the stop hunt strategy…

It doesn’t show which orders are stops.

A stop loss can be both a sell order and buy order. Which it is depends on whether the person who placed it decided to buy or sell; if they bought, it’s a sell order. If they sold, it’s a buy.

The order-book doesn’t give us any information on what type of buy or sell orders people have placed, it simply says they’re either buy or sell.

This means we have to figure which orders are stops ourselves. And this…

…isn’t as hard as you think.

You see, when somebody places a trade their stop order has to go either above or below the current market price, depending on whether they’ve bought or sold.

If somebody place a sell trade, their stop has to go below the current price. It can’t go above, because if the price falls it’ll take them out of the trade.

On the flip side to that, if someone places a buy trade, their stop has to go above the current market price, because if they place it below the price will hit it and they’ll get taken out of the trade.

Because of these two facts, we can make a simple observation about the order book:

The buy orders below the current price must (mostly) be stop orders from traders who have bought. And the sell orders above the current price must be stop orders from people who have sold.

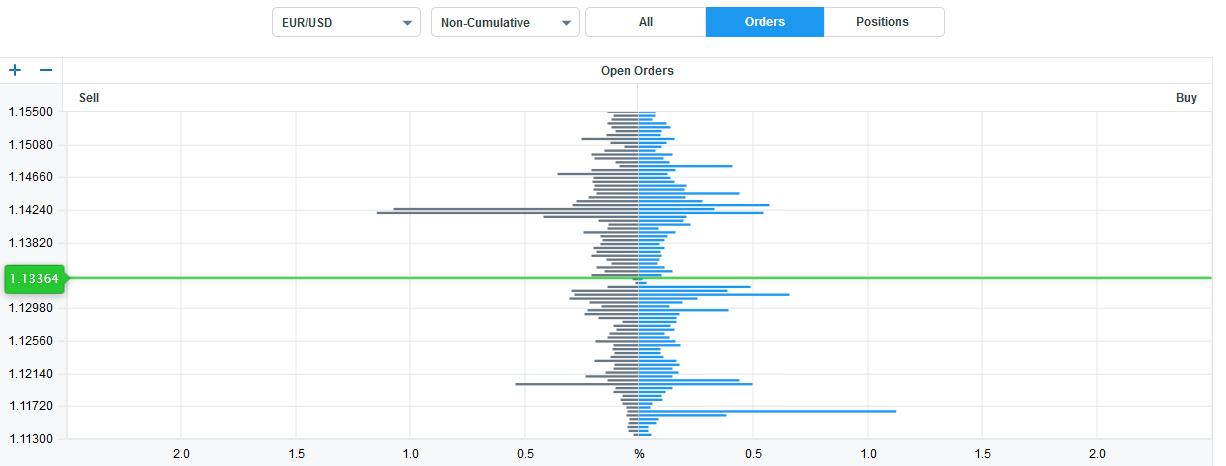

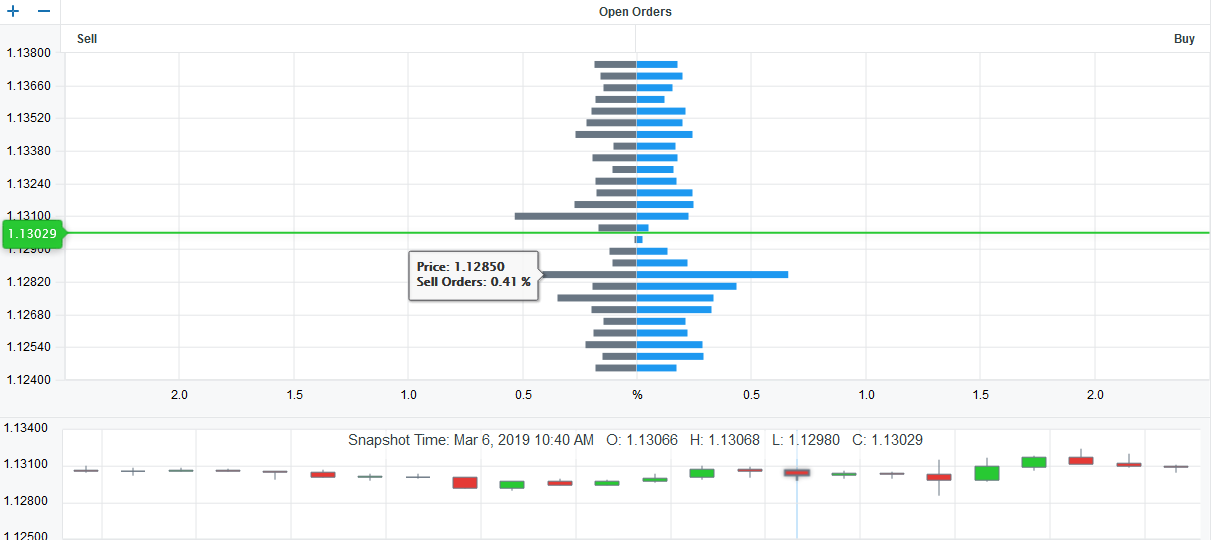

So to find out which buy and sell orders are stops on the order book, you simply have to look at the grey bars underneath the green line in the sell section and the blue bars above the green line in the buy section.

Trading Stop Runs Is Actually Pretty Easy

With all this talk of the order book, buy/sell orders, and stop losses, it’s easy to think that trading stop hunts is extremely difficult.

But it’s actually quite easy…

Let’s take a look.

Step 1: Wait For A Large Amount Of Stops To Build Up On The Order Book

Stop losses build up everywhere on the order book. But this doesn’t mean every little accumulation is an opportunity to take a stop hunt trade…

We only want to trade the highest probability setups. That means only trading the hunts against the biggest build-up of stop orders – build ups that equate to around 0.5% or more of Oanda traders.

Take a look at the image above.

See the big build of stops at 1.12850?

This build up constitutes to 0.41% of Oanda traders/investors – as seen by the scale at the bottom. While 0.41% isn’t quite the 05% required to be a high probability setup, it’s close enough. Which means this setup is suitable for trading.

To trade this stop hunt, you first need to mark a small area or line around the point where the stops have accumulated, which is 1.12850 in this case.

Next, you must wait for the price to reach the area or line to see if an entry appears.

Step 2: Enter A Trade AFTER The Price Hits The Stops

One of the key mistakes people make when trading stop hunts is they enter a trade using a limit order rather than waiting for a price action entry.

Using limit orders would be great way to enter, were it not for one thing…

Stop hunts don’t always work.

Sometimes the price just breaks though the stops as if they weren’t there. Other times it hits them but goes too far above or below before reversing, making it impossible to know where to place your own stop.

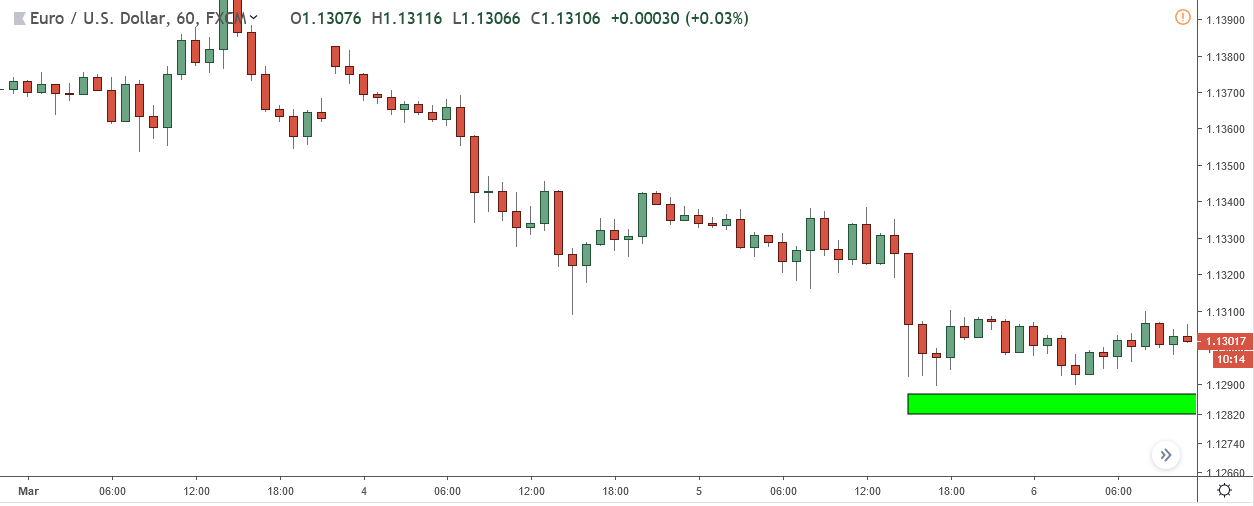

To enter a stop hunt trade, you must see an engulfing candle or pin bar form after the price hits the stops.

In our example, the price hits the stops and falls, causing a bearish Pin Bar to form.

Note: I know this isn’t the best pin but it’s close enough for this example.

So when you see this, you enter a trade and place your stop below the wick of the pin – the same as you would if you were trading the pin on it’s own or at support and resistance levels.

If it was an engulf that formed it’d be the same.

You’d enter the trade and then place the stop above or below the engulfing candle – just as you would trading it normally.

Simple.

Step 3: Exit The Trade

Knowing when to exit a stop hunt trade is bit tricky since it usually comes down to your own personal preference on how long you like to hold trades open.

In my experience, the reversals caused by stop hunts tend to be short lived.

Because of this, I suggest you either close a stop hunt trade soon after you see a large move take place, or – and this is probably the better option – aggressively take profits off the trade via moving your stop as the price goes in your favour.

Bottom Line

Stop hunts are the perfect setup to trade alongside your main strategy. They don’t happen often – not the high probability ones at least – but when they do they have a great chance of being successful.