Want to tap into those gigantic, market-changing trend reversals we sometimes see in forex?

You need to start focusing on psychological levels.

Don’t believe me?

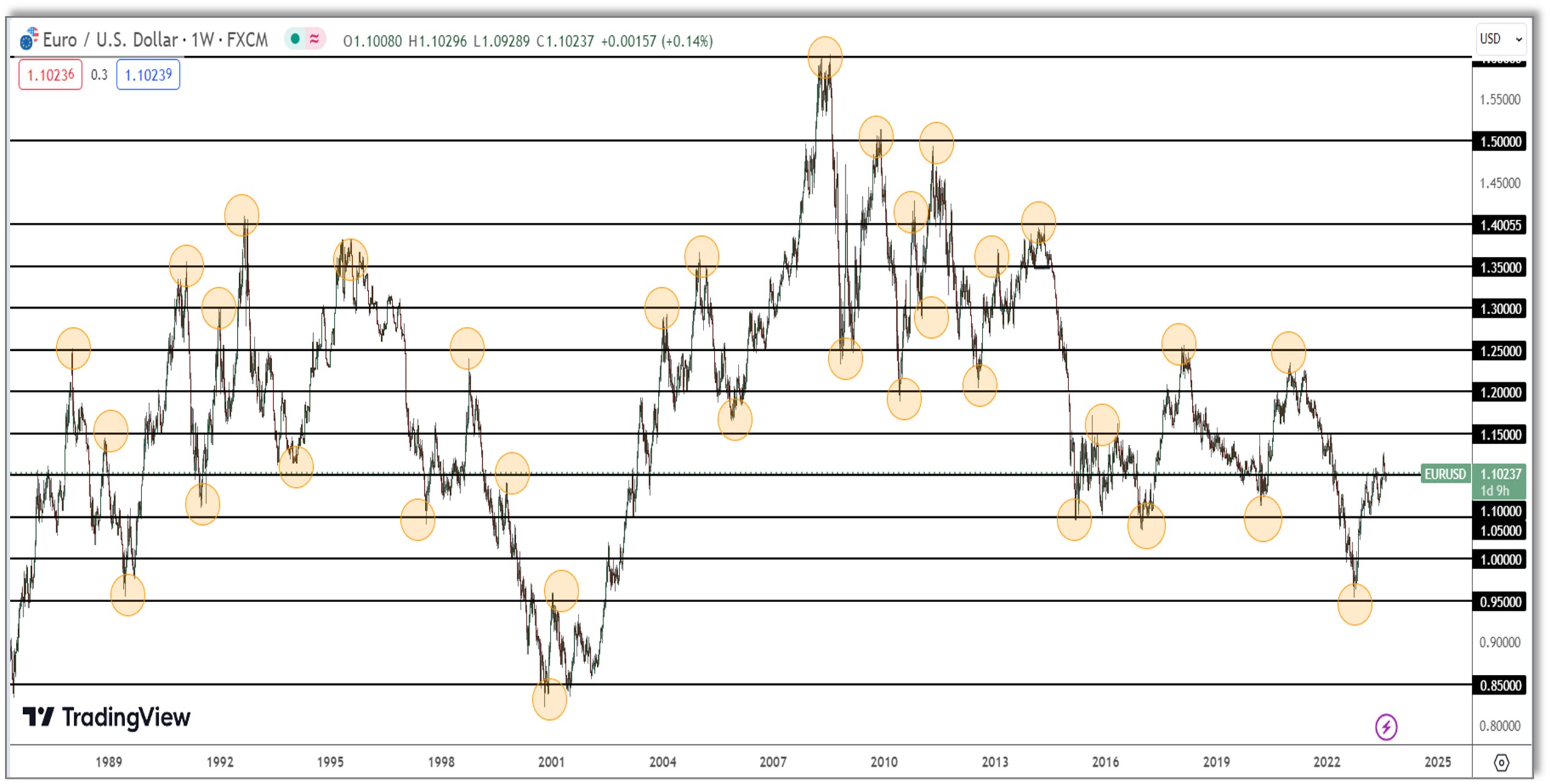

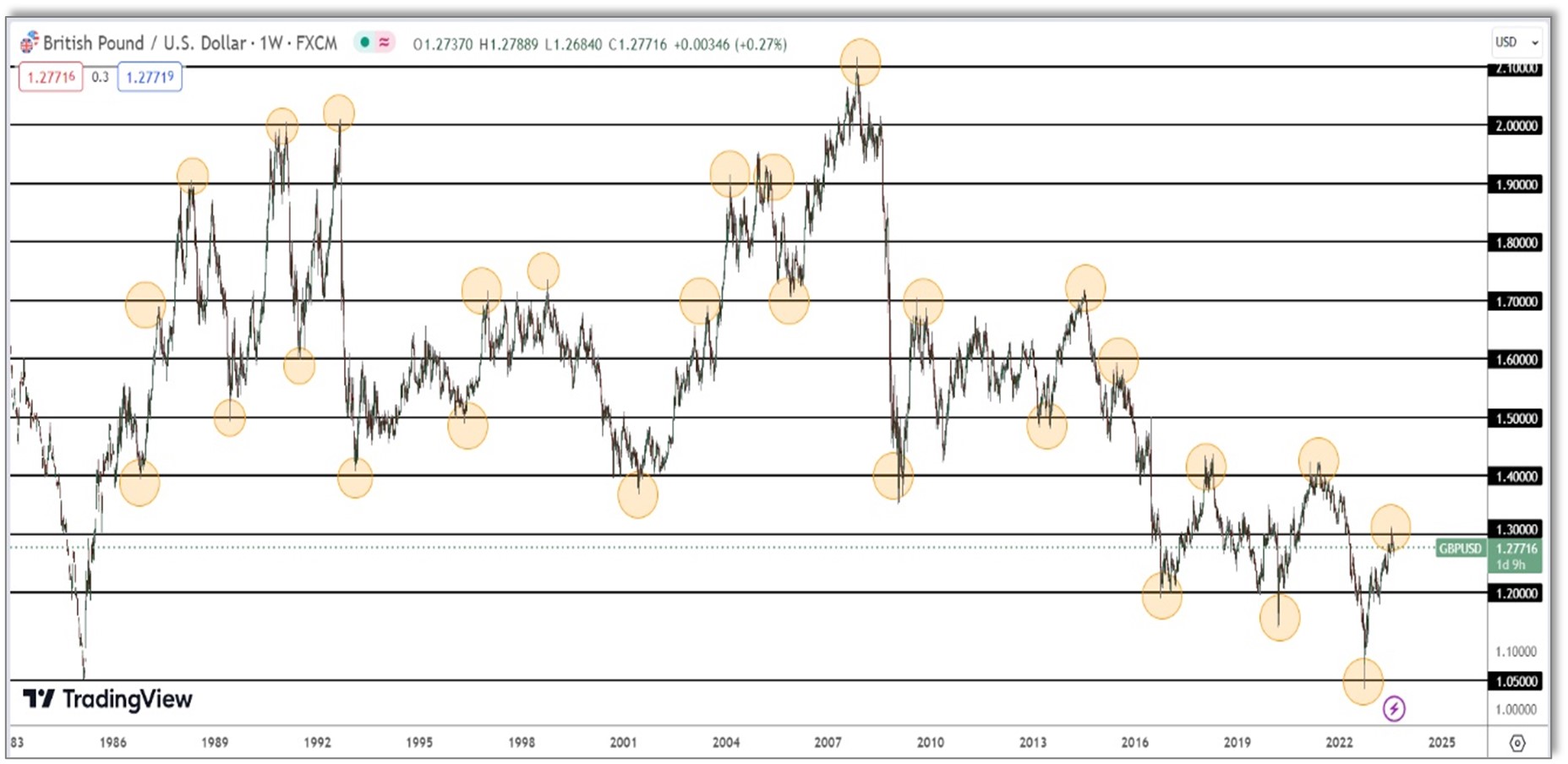

Check out the image below…

Here’s another one for good measure…

Psychological levels are, without a doubt, the most powerful yet overlooked technical level in forex.

Any price ending in 500, 000, or 0000 is classified as a psychological level—or big round numbers, as some folks call them. These prices hold colossal significance in forex, thanks to a phenomenon known as the order clustering effect.

Here’s a quick breakdown…

Order clustering is when people naturally gravitate towards placing orders around round numbers, rather than other arbitrary prices.

This happens partly because people are biased into thinking round numbers are somehow superior (because they’re bigger, of course). But also because humans are hard-wired to crave order.

For example: A number like 1.12500 is far more orderly than 1.12452.

So, why do trend reversals kick-start at psychological levels?

For the exact same reason I explained earlier…

Banks can never execute their full trading position in one fell swoop; they must fragment the position into smaller trades. This minimizes the number of opposing buyers/sellers needed and allows them to enter each trade at a similar price point.

(This, in turn, causes swing lows/highs to form at similar prices)

But here’s the key point…

Even after breaking down their positions, banks still lack sufficient opposing orders to enter at favourable rates.

To lighten the burden: Banks consistently push the price to points where a mass of orders exist.

And where do thousands of orders accumulate?

At psychological levels!

The order-clustering effect leads to a torrent of orders accumulating on and around these round-number prices.

By nudging price into these points, banks can trigger a landslide of opposing buy/sell orders. These orders aid them in entering at more favourable prices, making the execution of their trades far more manageable.

Take a look below…

The 6 swing highs above all formed at similar prices (due to the banks selling) around the 1.25000 psychological level.

Why?

Masses of buy/sell orders had accumulated around this 1.25000 level.

The banks purposely pushed price into this psychological threshold to help enter their sell positions at similar prices.

That’s why:

- #1 The highs all form around the 1.25000 level,

- #2 The highs themselves appear at similar prices.

So, here’s what happened…

- The banks pushed price into the psychological level,

- Used the orders to enter massive sell trades,

- Then brought the price back to enter more trades at a similar price.

The result: Multiple swing highs forming at similar prices within 100 pips of the psychological level.

That’s the magic of psychological levels/round numbers.

Pretty cool, huh?

Note: Learn how to mark and trade big round number zones in this post.

There are 3 main types of psychological level:

Major Psychological levels

Also known as ‘whole numbers,’ major psychological levels create the most powerful levels in the market. Expect significant trend reversals or retracements upon price reaching these levels.

Major psychological levels always end in whole numbers or fives.

Whole Numbers: Fives:

Usd/Jpy Eur/Usd Aud/Usd Usd/Jpy Eur/Usd Aud/Usd

110.000 0.90000 0.60000 115.000 0.95000 0.65000

120.000 1.00000 0.70000 125.000 1.05000 0.75000

130.000 1.10000 0.80000 135.000 1.15000 0.85000

140.000 1.20000 0.90000 145.000 1.25000 0.95000

Does that make sense?

Major psychological levels create powerful reversals… Why? Because of the influence of banks and financial news media, which use these levels as milestones to gauge when a currency has reached a significant price.

For example:

When USD/JPY reached 150.000 on 05/10/22, outlets like FXStreet, Reuters, Bloomberg, and many others were quick to report it…

See for yourself:

https://www.reuters.com/markets/asia/yen-is-past-key-150-threshold-whats-next-2022-10-21/

https://www.fxstreet.com/news/usd-jpy-set-to-reach-150-as-yen-weakness-lingers-anz-202209270700

What happened next?

Price tanked for almost an entire month!

Coincidence?

Here’s why…

The financial media’s buzz around the price reaching 150.000 set off a ripple effect. It prompted swathes of traders—both retail and professional—to dive in and buy.

And it’s not just traders… Companies also join the fray:

- Traders buy with the aim of profiting from a further price rise.

- Companies buy for various business reasons like resources, services, etc.

Together, this results in thousands of new buy orders flooding into the market, concentrated around the 150.000 price range.

And who’s always in need of a mountain of buy orders?

Our friends: The banks.

These banks—many of whom own the financial news media, let’s not forget—capitalize on this massive influx of buy orders. They use it as an opportunity to take profits off their already-open buy positions… And what’s the result?

Price reverses and tumbles back down to…

Yep, you guessed it…

The 130.000 level!

Another MAJOR psychological level.

How about that…?

And for anyone who thinks I cherry-picked this example… open your charts and take a look at any pair…

You’ll see the same process again… and again… and again:

Almost ALL major trend reversals or significant retracements will begin at or near—when price is within 100 pips above or below—MAJOR psychological levels.

It’s as clear as day on any pair and any timeframe…

Check it out yourself.

Minor Psychological Levels

Minor psychological levels form the most common levels in the market but hold far less weight than the major levels we’ve just dissected.

These minor levels usually spawn small reversals, retracements, and pauses… Why?

Due to the lower volume of buy/sell orders clustered around these levels. However, some will ignite large, market-changing reversals/retracements.

Minor psychological levels also manifest as whole numbers and fives…

Whole Numbers: Fives:

Usd/Jpy Eur/Usd Aud/Usd Usd/Jpy Eur/Usd Aud/Usd

110.000 0.99000 0.61000 111.500 0.99500 0.61500

111.000 1.01000 0.62000 112.500 1.05500 0.62500

112.000 1.02000 0.63000 113.500 1.06500 0.63500

113.000 1.03000 0.64000 114.500 1.07500 0.64500

While lacking in power compared to major psychological levels, minor levels can still prove extremely useful when trading.

Here’s the top ways I use them:

- To find confluence with other technical points (like supply and demand zones).

- To anticipate where price may stall or retrace during trending moves.

- To predict where price may reverse when no other technical points exist.

Let’s dive into some examples…

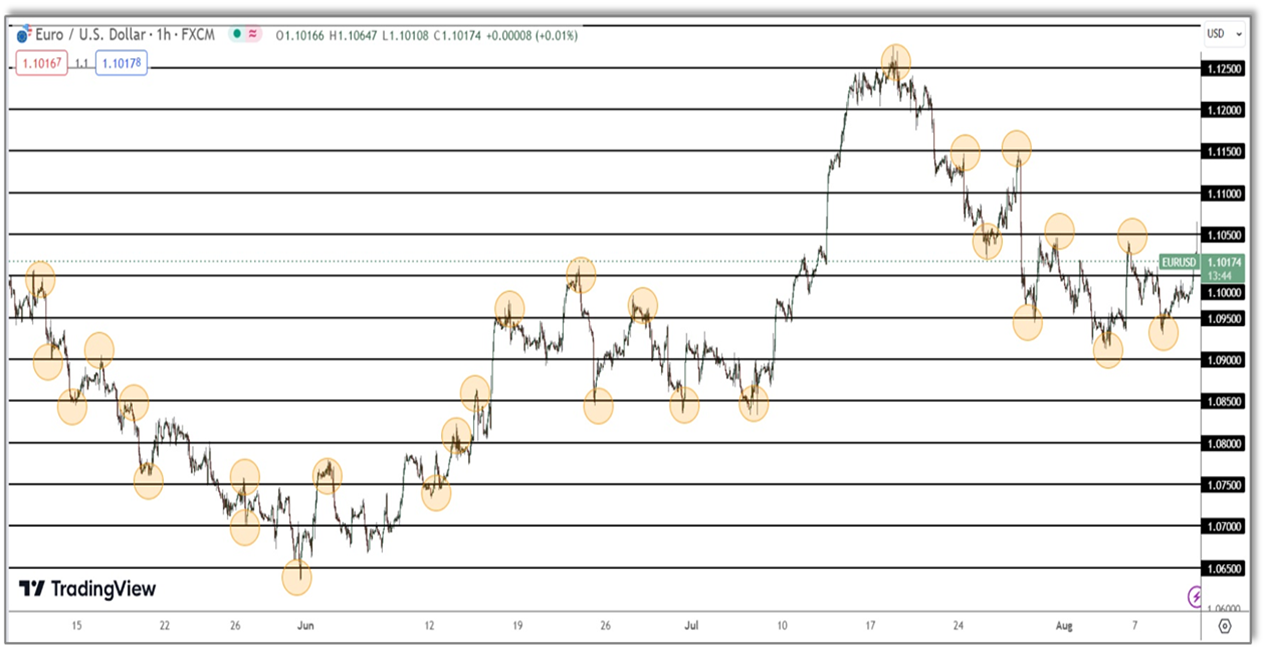

See the tiny little retracements and pauses created during this rise?

What caused these?

Was it…

- Resistance levels?

- Supply zones?

- Randomness?

NOPE – It was minor psychological levels.

Check it out again…

Most small retracements and pauses began when the price was at or near a minor psychological level, sometimes to the pip!

Pretty cool, right?

Fun fact: When the price breaks a low or high, the market will often return to retest the nearest minor psychological level. Traders assume this is support turning into resistance, or vice versa, but it’s usually a minor psychological level retest.

Here’s another one…

These demand zones on Usd/Jpy aren’t considered powerful, however, they all manage to initiate a reversal.

Why, you ask?

What do these zones all have in common?

Can you guess what it might be?

Look again…

Each demand zone has a minor psychological level (ending in 500) either running through the zone or located nearby.

The psychological level BOOSTED the zones’ chance of success!

See the power of these levels now?

Spend some time marking major and minor psychological levels; observe how the market interacts with them and which price action comes up. Many of your previous trades may have ended differently had you known about these levels at the time.

Grab Your FREE E-Book:

5 Pro Rules For Trading Supply And Demand

- Master the core principles of supply & demand.

- Advanced techniques for trading SD zones.

- Exclusive new lessons/books/tools every week!

Sign Up Now To Download Your FREE Guide:

🛡️ Spam-Free Promise: No spam, ever. We'll only send you relevant updates and content. Unsubscribe at any time.