Most people know support and resistance levels to be lines drawn on top of points where the price has reversed from in the past.

That’s the classic definition of the levels, and that’s the one everyone knows.

But there’s another type of level that exists…

A level that isn’t drawn on top of the points where the price has reversed multiple times in the past (though these points do often fall in line with the level) and not discussed by most price action traders.

Where are they found…

At big round numbers.

In this post, I’m going to explain why big round numbers make great support and resistance levels and show you how to use them in your trading.

How Do Support And Resistance Levels Form At Round Numbers?

Round numbers are probably one of the least likely places, or prices I should say, you’d expected support and resistance levels to form at, and for good reason…

…they’re just numbers.

But some interesting things happen at round numbers that makes them such good S & R levels…

Before we get to that though, let me be clear on what I mean by ‘big round number’.

A big round number (or whole number, as they’re sometimes called) is any price that ends in 00, 000 or 0000.

Numbers that end in a single 0 e.g 1.2340 are round numbers as well, but they hold little significance, so we don’t use them as support and resistance levels.

So, what happens at big round numbers to make them such good support and resistance levels?

The best way to answer this is with a question…

If you bought a new car for 34,899 and I asked you how much it cost, what would you say?

Probably 35,000, right?

You’d round the price up to the nearest whole number because it’s easier to remember – and maybe to make it sound a little more expensive.

But here’s the interesting thing…

Traders and investors do the same when placing their orders.

Rather than place their orders at complicated, difficult to remember prices, they round them up and place them at the nearest big round number.

The result?

A huge number of buy, sell and, stop-loss orders accumulate at big round number prices.

This is an image taken from the historical order graph – a tool that shows where Oanda traders used to place their stops on Eur/Usd.

Look at the red patches, notice anything?

The highest concentration of orders – shown by the deep red patches – are found at big round numbers prices – 1.2300 and 1.2340 in this case.

So during this time – this was taken from a few years ago – most traders decided to place their buy, sell, and stop orders at big round numbers, confirming their significance in the market.

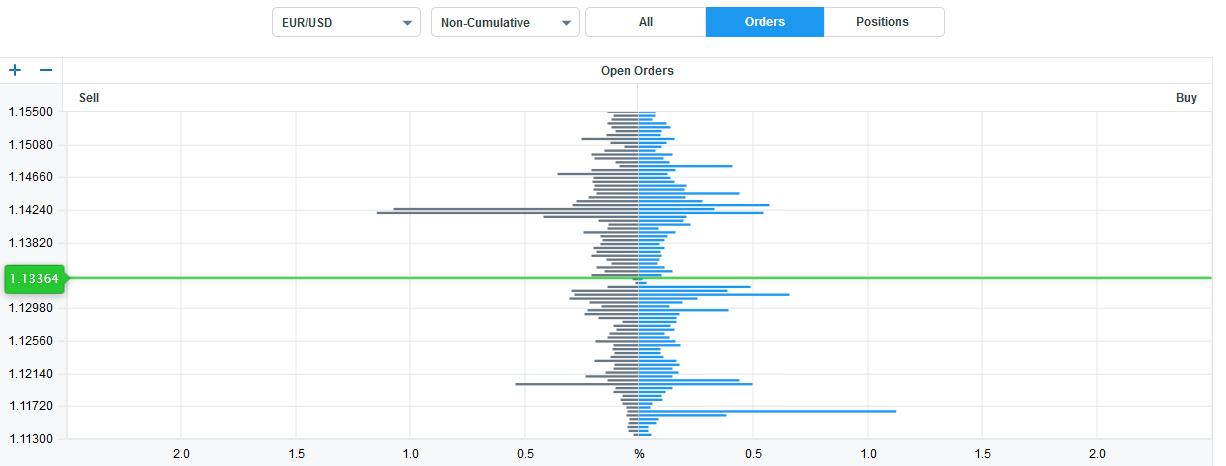

Here’s a picture of Oanda’s Order-book tool I took from the other day.

Note that the biggest bars, which represent buy, sell, and stop orders, all form at big round number prices.

So, as you can see, vast quantities of buy, sell, and stop-loss orders do build up at round number prices, making them great S & R levels.

But how do you use these levels in your trading?

Let’s take a look…

Using Big Round Numbers As Support & Resistance Levels

The way you use big round numbers as support and resistance levels is basically the same as how you use the levels normally; you mark them on the chart and then wait for the price to return.

There’s one thing to remember, though…

Big round numbers are not all the same.

Some numbers have a higher probability of causing the price to reverse than others due to their prominence in the market.

Generally speaking, the prices that end in 500 and 000 cause the biggest reversals.

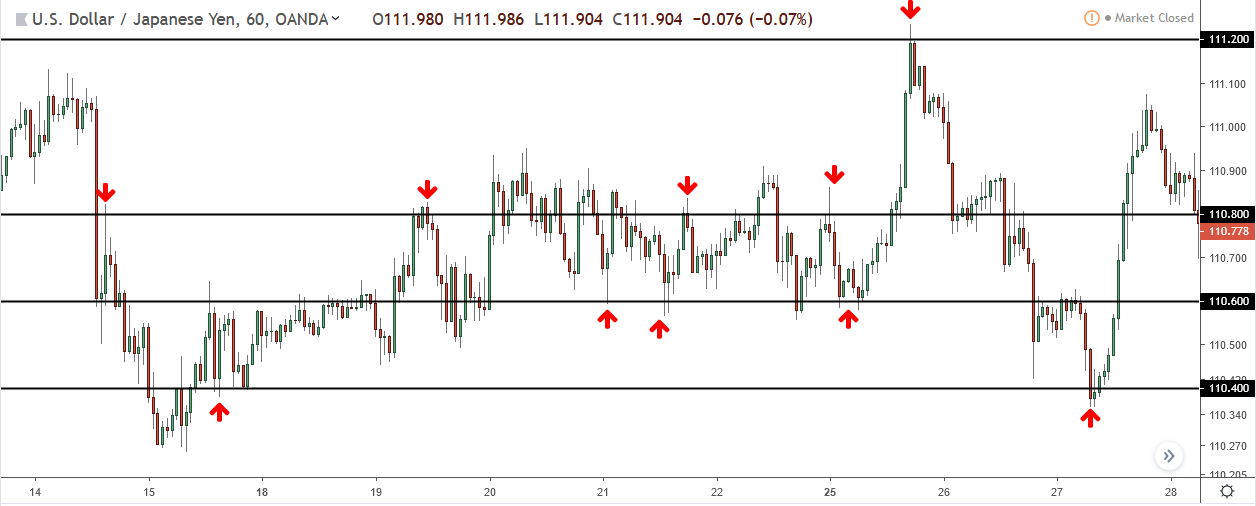

If we look at Eur/Usd, you can see the biggest turns between the 18th and 5th took place when the price was at or near 500 or 00 prices.

While the 500 and 000 prices tend to cause the biggest reversals and are the ones you should mainly watch, the 200, 400, 600 and 800 prices also cause large ones too…

These are a bit hit and miss though, so don’t count on them too much.

Mark The Numbers As Zones For Easier Entries

While support and resistance levels work good as lines, they work much better as zones. And this goes for round number S & R levels too.

Here’s an image of Eur/Usd with the 500 and 000 levels marked as lines.

And here it is again, but with the levels marked as zones.

And here it is again, but with the levels marked as zones.

See the difference?

When the numbers are marked as lines, there are lots of times when the price either breaks far below the line before reversing or misses it completely – just like normal support and resistance levels.

As zones, however, this rarely happens, making the big round numbers much easier to trade.

Summary

Big round numbers are a great place to look for reversals, and I recommend you definitely start watching them. While the 200, 400 and 800 levels do work well, I think it’s best to concentrate on the 500 and 000 levels, as they tend to cause the biggest reversals therefore are a good additional point to watch.