I’m sure you’ll agree…

In trading, your entry plan is just as important as your exit plan in order to have a successful trading career. And this applies to both newbies and experienced traders participating in the forex market

Today, though, we’re going to talk about the exit plan.

But, we’re going to zero in on the most key aspect, which we call a ‘Stop Loss Order’. This is a super important tool that helps manage risk.

Basically, it limits how much damage a trade can do to your account.

Here’s the wild part though: Even though most traders know about stop loss orders, many tend to ignore them when they’re in the heat of trading. Why? Well, the reasons can differ from one trader to the next. But the big issue is that they don’t fully understand the true purpose of the Stop Loss Order.

Why is that?

Probably because most of the training and resources out there focus more on how to buy and sell. They think that’s where all the trading magic happens.

But there’s more to the story…

You might be scratching your head right now because I just said most traders know what a Stop Loss Order does.

So, what do I mean they don’t understand its “real use”?

No worries, by the end of this article, it’ll make sense.

In a nutshell, the real magic of a Stop Loss Order lies in your trading psychology or mindset. It helps you understand that trading is a numbers game. Stick with me as we go through this article, and I’ll explain more about how this helps.

First, we’ll quickly go over what a Stop Loss is, how to use it, and most importantly, why we need it. Don’t worry, this should be pretty easy to understand.

I’ll use some cool visuals to help highlight important points.

Let’s roll!

What Is A Stop Loss And What It’s Used For?

Important Note: Heads up!

The main goal of this guide is to explain “Why We Need To Use A Stop Loss”.

But first, let’s briefly go over what a stop loss is and why it’s used. We won’t spend a ton of time on this, so if anything feels confusing, you might need to do some extra research to clear things up.

We’re really going to focus on answering the big question.

Definition

So, what’s a stop loss?

A stop loss is like a safety net you can add to your trade when it’s placed or after its been exectued. Traders use stop losses to automatically exit a trade if price reaches a certain point and things aren’t going their way. This helps limit their losses.

Here’s an example to show you what I mean:

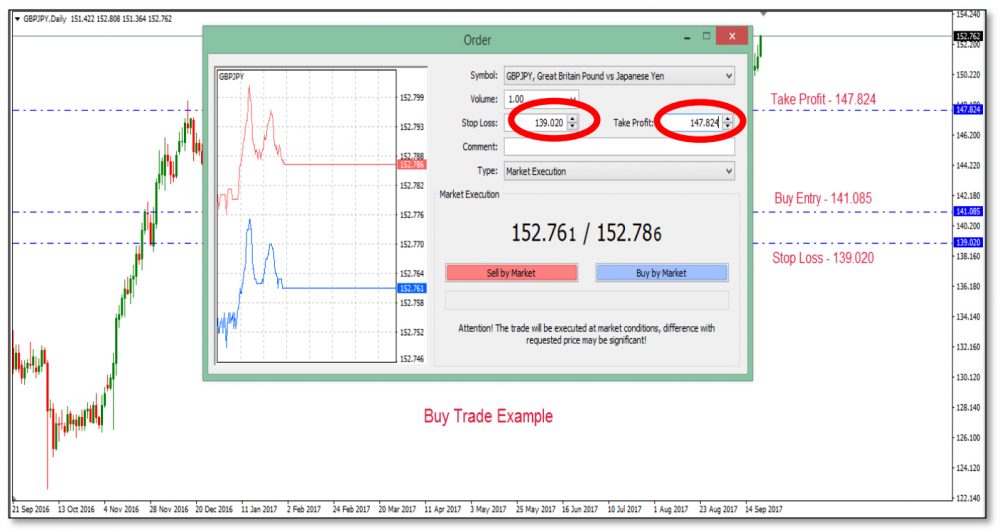

Figure 1: GBPJPY Buy Trade Example

Say you decide to enter a trade at 141.085 because your strategy tells you it’s a good time to buy. You then set your stop loss at 139.020 and your take profit at 147.824.

What does this mean?

Well, once your trade is executed, there are two ways you can exit.

If price drops to 139.020 (your stop loss), you automatically exit to limit your loss. But if things go according to your plan and the price hits 147.084 (your take profit), you also exit, but this time with a profit.

You can set these levels manually on MT4, and it looks something like this:

Figure 2: Understanding Stop Loss and Take Profit Levels

The picture above, labeled as Figure 2, highlights two essential concepts: “Stop Loss” and “Take Profit.”

We set these manually when we’re trading on platforms like MT4.

Types of Stop Losses

There are two basic types of stop losses, namely ‘hard stop loss’ and ‘trailing stop’.

Let’s break these down for you:

Hard Stop Loss

Imagine playing a video game where if you lose a certain number of lives, the game stops. That’s pretty much what a hard stop loss is like. You set a specific level, and if the trade hits this level, it automatically shuts down at the current market price.

Think of it as a safety net so you don’t lose too much.

You can see an example of this in Figure 1.

Trailing Stop Loss Order

This one’s a bit different.

It’s like having a protective bubble around your trade that only moves when price goes in your favour. If price goes against you, your ‘bubble’ or stop loss doesn’t move, much like the hard stop loss. But if the price goes in your favor, the stop loss moves with it.

Hence the name “Trailing Stop.”

This kind of stop loss is usually used to minimize risk when a trade is ongoing.

Just remember, even with a hard stop loss, you can adjust it as your trade starts to go your way. However, we won’t be discussing this much further in this article.

Why Do You Need a Stop Loss?

Now that we know a little about stop losses, let’s talk about why they’re so important.

I mentioned earlier that the primary purpose of a stop loss order is to help with your trading mindset and that trading is all about playing the numbers right.

In this section, we’ll dive deeper into these points and make them super easy to understand.

1. Trading Psychology or Mindset

Who we are against in the game?

The forex market is a bit like a game with players ranked by their power.

Let’s visualize this to make it clear:

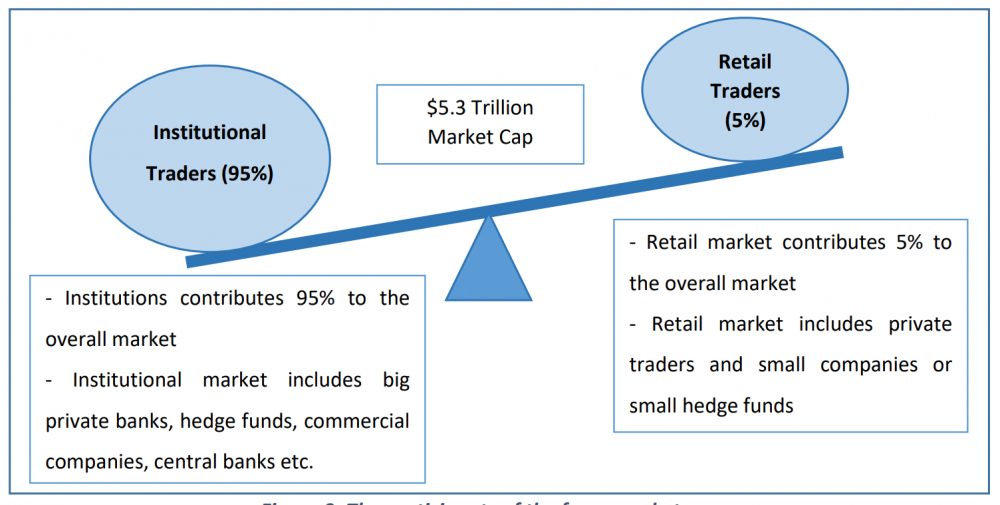

Figure 3 shows two kinds of players in the forex market: institutional traders (like big banks) and retail traders (like you and me).

The big guys, the institutional traders, are the power players in this game.

We, the retail traders, are the underdogs.

Our chances of winning are pretty slim unless we learn to play the game like the big players.

Now you’re probably wondering, “What does this have to do with using a stop loss when trading?”

Well, understanding who’s in control of the game helps us realize that trading is risky. Why? Because we don’t control the game. So, our number one job before we even think about making money is to protect what we have.

This is called risk management, or more simply, looking after our money.

Robert Kiyosaki, a successful investor, said, “Just because investing comes with risk, that doesn’t mean it has to be risky.”

What does he mean by that?

Well, let’s think about driving a car.

Buying a car has risks – you might crash or lose it.

But driving a car with faulty brakes and no seatbelt is even riskier. Why? Because you’re ignoring the things you could do to stay safe.

The same thing applies to trading without a stop loss.

If you trade without a stop loss, you’re ignoring one of the ways you can protect yourself. Many retail traders think that a good trading strategy is the only key to success and forget about risk management.

You might see people bragging online about winning 98% of the time or “killing the market”, but the reality is often very different.

After all, remember Figure 3 – the big guys are in control.

Thinking In Probabilities

We’re going to talk about a concept taken from a brilliant book by Mark Douglas, “Trading in the Zone.”

If you’re into trading and haven’t read this book yet, you should definitely check it out. It explains an important thing that separates successful traders from those who end up losing money.

Douglas says the big difference between winners and losers in trading is all about mindset. It’s how they think about their actions, instead of just doing what everyone else does.

He uses two ideas to back this up, which I’ll explain separately:

The first idea is what he calls a “micro-level belief.”

Douglas argues that every trade outcome is unique because even a tiny change can mean the difference between making a profit or suffering a loss. This means the results of trading are random – if some aspects change, the whole outcome can shift.

By aspects, I mean the specific circumstances when we decide to trade.

Trading during high-impact news events will be different from trading during calm times. The market reacts differently if there are elections or any big news events, or when nothing much is happening.

Therefore, because any aspect can affect our results, each trade’s outcome is uncertain. But let’s move on to the second idea.

The second idea is called a “macro-level belief.”

Here, Douglas says that while a single trade’s outcome is uncertain, if we look at a large number of trades, we can start to see a pattern in our trading results.

Let’s use a popular casino game, blackjack, as an example.

In the game, you don’t know who’ll win each hand, but if you play a lot of hands, the player who’s good at the game will start to win more often.

The same thing happens in trading.

Think of each hand of blackjack as a trade.

Once you’ve made many trades over a certain period, you can start to see if you’re making or losing money. This shows that you need a certain number of trades to tell if your trading strategy is working. But this brings us back to the main point of this article – why we need to use a ‘stop loss’ (a tool that limits your potential losses).

Let me ask you this: How can you make many trades to see if you’re winning or losing money if you’re not managing your risks properly?

Using risk management techniques, like a stop loss, means you control your potential losses.

More importantly, it allows you to keep trading day after day. That’s exactly what you need for your trading strategy to work and start making you money.

Trading Is A Numbers Game

By now, you should know that using a ‘stop loss’ is not only about guarding your money from losing too much, but it’s also about recognizing that trading on the forex market can be risky.

It’s about understanding how the big-time traders think and act. But in this part, we’re going to explore the “numbers game”, specifically two ratios that are super important if you want to be a successful trader.

These ratios are called ‘Trade Sizing’ and ‘Lot Size’ (or Volume).

We’ll also see how ‘stop loss’ plays a role in these ratios.

Let’s break these down separately:

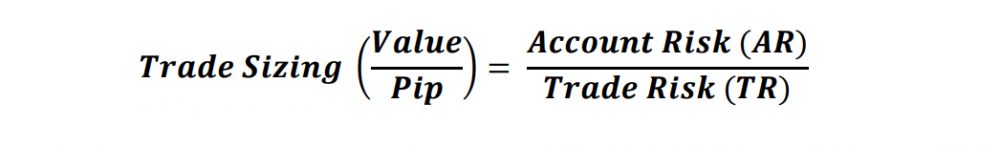

- Trade Sizing

This is all about figuring out the value of the pip (or basis points, fancy term for a type of percentage) you’re trading. This gives you an idea of the risk and reward involved in terms of points.

Here’s what the ratio looks like:

Now, let’s move on to the next important term…

Account Risk – The amount of money that is prepared to be risked on each trade based on the account size. The rule of thumb is that never risk more than 1 – 2% of the overall account in one trade.

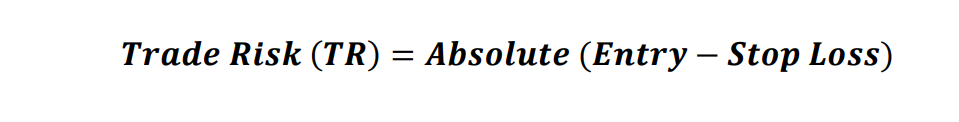

Trade Risk – The number of points that a particular trade has at risk. It is the absolute difference between Entry Point and Stop Loss prices.

The formula is seen as follows:

The example to explain this concept of trade sizing can be seen as follows:

Example:

Account and Trade Conditions

Equity (Account Balance) = $10 000, Entry Price – 1. 6500 and Stop Loss – 1.6450

Let assume you take a long position on GBP/USD

Calculation

Account Risk (AR) = $10 000 * 2% (Maximum) = $200

Trade Risk (TR) = Absolute (1.6500 – 1.6450) = 0.0050 = 50 pips or points

Therefore, Trade Sizing = Account Risk/Trade Risk = $200/50 pips = $4/pip

> The $4/pip value is the amount that will be multiplied by the number of pips made or lost during the trade, in order to work out the total money made or lost.

For example, if you make 100 pips in a trade, then the profit will be $400 ($4/pip *100 pips).

So, why is this ratio, called “trade sizing,” so important?

It helps you plan out your trades based on how much money you’ve got in your account and what you’re profit expectations are. Trade sizing allows you to pre-determine how much you could win or lose based on the trading strategy you choose.

Pretty cool, right?

This way, you can look at trading from a big picture perspective, sort of like planning a road trip.

Lot Size or Volume

Then, there’s something called Lot Size or Volume.

When we place trades on a trading platform like MT4, we use this term. It shows the number of contracts we’re buying or selling with each trade, which is basically what we’re risking.

The types of contract sizes are shown in the following ways…

1 Lot: 100 000 units (or 1 Standard Lot)

0.1 Lot: 10 000 units (or 1 Mini Lot)

0.01 Lot: 1 000 units (or 1 Micro)

You may have seen on various websites or in books this golden rule: never put more than 1 – 2% of your account at risk in a single trade. Yet, it might surprise you that a lot of traders aren’t sure how to apply this 1 – 2% risk idea when figuring out how much to buy or sell in their trades.

So, let’s go through an example to help make this clear.

Don’t worry, I’ll explain everything in a way that’s easy to follow.

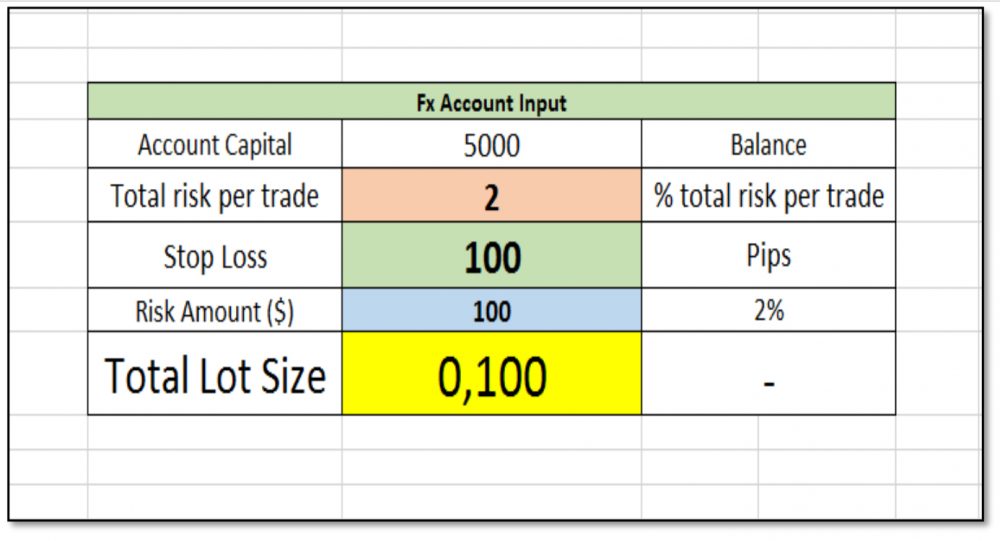

Figure 4: is a ‘lot size calculator’ which shows how to work out how much to buy or sell following the 2% rule.

In this example (Figure 4), you can see calculations done using Microsoft Excel.

These calculations help determine how much to buy or sell (or in trading terms, the ‘lot size’) for each trade, assuming you don’t want to risk more than 2% of your account.

I’ll take you through each step to explain how this calculation works.

If you’re not already doing this for your trades, I recommend you start.

Professional traders use this approach every time they make a trade, and it can make the difference between winning and losing in the trading game. Now, let’s go through the example below to understand what’s shown in Figure 4.

Example: Figure 4 Explanation

Let’s say your Account Balance is $5000 and you only want to risk 2% per trade.

The question now, how do you calculate your lot size that you will use on MT4.

However, please note that in order to do this you must know two things, how to use basic functions of Excel and where you will place your stop loss.

Step 1: Input information

Set up the table as shown in figure 4 on the Microsoft Excel Spreadsheet, but only put the account capital and total risk per trade values e.g. in this case, $5000 and 2% respectively

Step 2: Risk amount calculation

Calculate the capital risk amount as per your risk exposure appetite. But here we want to calculate the 2% of $5000, which is done as follows

Risk Amount ($) = Risk % * Account Capital ($) = 2% * $5000 = $100

Step 3: Lot Size Calculation

Calculate the lot size or contract size that you will use in your MT4 trading platform. However, in order to do this you need one extra information which is your Stop Loss Placement in terms of pips.

The calculation is as follows:

Lot Size = ROUNDDOWN (Risk Amount/Stop Loss Pips/10; 2)

The “function” for this calculation is available on excel, you just click on the cell and type ROUNDDOWN, and click the cells of Risk Amount and Stop Loss Pips as shown on the equation.

Lastly, put 10; 2 to complete the equation and press enter.

This will calculate the Lot Size you will use in your MT4.

I am sure you can agree that this variable depends in two things, the amount to risk per trade and stop loss placement. Therefore, if we assume that we only use fixed risk amount like 2% rule per trade, then the only thing that will make this variable to change is our Stop Loss Position (PIPS).

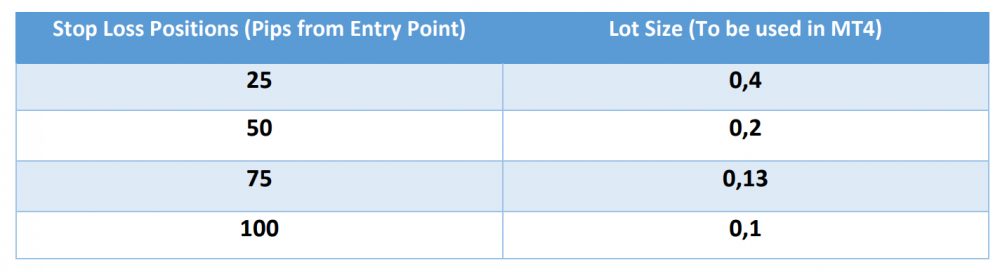

To explain this further, let’s look at the following table.

So, check out Table 1 above.

We made it using the calculation shown in Figure 4 by following steps 1 to 3.

The only thing we changed up was the Stop Loss Position, which we ranged from 25 to 100 pips. We wanted to show you that just because you’re risking a fixed percentage on each trade, your stop loss position can really change the size of your lot (that’s like the size of your bet).

You’ll notice that the bigger your stop loss position is, the smaller the lot size you’ll use for your trade. But what decides your stop loss position?

That’s your trading strategy, basically how you decide to enter trades.

The important part here is that you need to know your stop loss position in advance for every trade, so you can calculate what lot size to use. If you follow this process, you’ll be able to control your risk and avoid emotional trading (which is never a good idea).

This way, you stay in the game for the long run.

Now let’s summarize everything:

The Bottom Line

A lot of casual traders kind of get the concept of using a stop loss, but they often skip it.

They think their trading success only depends on how they place buy and sell trades. But let’s think about successful companies like APPLE or Coca Cola.

Sure, they make cool stuff, but a huge part of their success is focusing on managing risks. They know there are always hazards and they need to identify, analyze, control, and accept them. This is key to their success and the same idea applies to us in trading.

Trading is risky because of the way the market is set up, but it doesn’t have to be super risky.

The difference is planning.

You have control over your trading approach.

You need to know how much to risk (lot size) for each trade, and you can’t know that without knowing where to put your stop loss. Unfortunately, a lot of people ignore this because with MT4 (a trading platform), you can just randomly put any lot size you want.

That’s why you can see people online trading 1 standard lot with just a small account.

But the sad truth is that they often lose their money after a few trades.

Your lot size is connected to your stop loss position – they’re like two peas in a pod, you can’t separate them. But you’ve got to remember this every time you trade.

Here’s the sad part: many traders don’t really think about why they’re doing something and its benefits. As a result, they often lose their accounts when they hit a losing streak.

Think about what you’re doing and why you’re doing it.

It’s not just about using the stop loss but about surviving so you can learn, improve, and achieve your goals. Always use your stop loss order and follow your risk management rules.

If you do, you’ll stay in the game.

If you don’t, you’re out.

Stop being part of the 95% of traders who lose money every day. You’ve got to control your mind and your destiny, or someone else will.

Trust me, you don’t want that.