Trading is like any other skill and as such, needs to be improved over time.

But, you might wonder, how can you actually get better at trading?

Well, there’s a pretty simple way: keep a trading journal!

Today, I’ll break down what a trading journal is and show you how it can seriously up your trading game. Let’s dive in!

What Is A Trading Journal?

A trading journal is pretty much like any journal where you jot down important events or thoughts. The twist? Instead of logging your everyday life events, you’re keeping tabs on the trades you make.

Why bother with this, you might ask?

Well, there are some cool reasons…

First off, it helps you see the big picture. Many new traders stress too much about whether each trade is profitable. But hey, over time, you’re going to make loads of trades. So, having a journal with all your trades helps you view each one as a piece of a larger puzzle, instead of as a make-or-break event. It takes the pressure off.

How To Create A Trading Journal

There are lots of ways to do this. You can use a spreadsheet or a word doc on your computer, use an online program, or go old school and jot everything down in a notebook.

But here’s the key: what you write in your journal matters way more than how you make it.

The more details you put in your journal, the better it will help you improve your trading. So, what should you jot down?

You’ll need two types of info:

Basic info – This is the simple stuff like what currency you bought, the price you bought it at, how much you bought, where you set your stop loss order, the max amount you could’ve lost, and how much you actually made or lost.

Advanced info – This is more about what you did during a trade. Like, did you sell too early because you thought the price would drop (even though it didn’t)? Or did you take your profits too soon because you saw some big news was coming?

The basic info lets you see how well your trading strategy is working. The advanced info helps you spot any mistakes you’re making and figure out how to fix them.

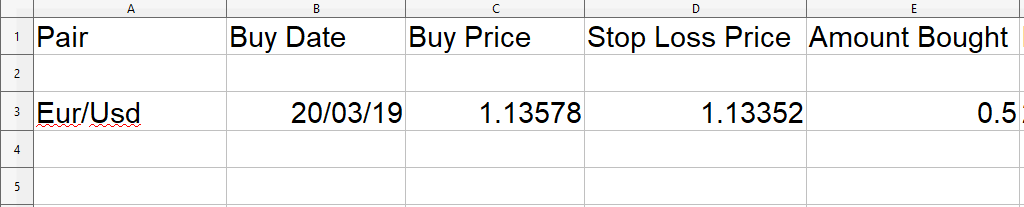

In my view, the best way to keep track of basic trade information is through an Excel spreadsheet. Let’s take a look at what info it should include.

– Pair

Which pair you bought when your strategy gave a buy signal

– Buy Date

The date you bought the currency at.

– Buy Price

The price you bought at.

– Stop Loss Price

The price the stop loss was placed at immediately after entering.

– Amount Bought

The amount of currency purchased when your strategy gave a buy signal.

– Max Risk

Here you need to enter the maximum amount you could lose if the price falls and hits the stop loss.

To figure out what this is work out what the difference is between the buy price and stop price and then subtract that from the amount you bought.

– Sell Date

The date you sold.

– Sell Price

The price you sold at.

– Profit/Loss

How much you made or lost on the trade.

– Reason For Entering

The reason you decided to buy – this will be determined by whatever strategy your using.

How A Journal Will Improve Your Trading (And Investing)

Keeping a record of all your trades and investments, including details like buying price, selling price, profit, and so on, is a good way to track how well you’re doing. It can help you figure out if you need to change your game plan. But, when it comes to actually getting better at trading and earning more money, those details don’t help a lot.

What does help is writing down what you were thinking and what you decided to do while a trade or investment was ongoing.

Most of the slip-ups that happen while trading and investing aren’t because you don’t know enough or your strategy is bad. Instead, they happen because you make decisions based on feelings – choices that aren’t based on good reasoning or logic but on what you think might happen to the price.

Because these mistakes are based on emotions, they can be really hard to spot (some people don’t even realize they’re mistakes at all!). But if you write down your thoughts and actions in a journal, you can spot these errors more easily and fix them.

For example, there’s this thing called panic selling, which is when you sell just because the price went down, even if you had no clue about how much it would drop. This mistake can make you miss out on a big profit (if you sell when you could have made money) or lose money and a chance to make a profit (when you sell because of a price drop before it goes higher than your buying price).

Because panic selling is so random, it can be hard to figure out how much it’s affecting your trading. Like I said before, some people don’t even think it’s a mistake.

This is where a journal comes in handy.

If you sell out of panic and write in your journal that you did it because you thought the price would keep dropping (even though it didn’t), you can look back later and figure out how much money it cost you. If you see that it happens a lot and that it’s made you miss out on big profits, you’ll be way more motivated to stop doing it.

As a result, you’ll start making more money.

The Bottom Line

A trading journal might not seem like the best way to get better at trading, but trust me, it’s one of the best methods if you do it right.

Remember, a journal is only as helpful as the stuff you put in it. The more details you write down in your journal, the more you’ll be able to learn from it, and the easier it will be to figure out how to get better at trading.