I’ve always said the best way to trade is to have one core strategy and then several setups that provide less signals but that have a higher probability of working out.

Finding a suitable strategy is pretty easy, but finding a few decent setups to trade alongside it…

That’s a lot tougher.

To make it easier, I thought today I’d share with you a reversal setup I’ve been using for a quite a few years now with good success.

Want to learn what it is?

Then read on…

The “Secret” Retracement Level Nobody Uses

The fibonacci retracement tool is best known for its 4 levels that show where the price can reverse during a retracement:

The 23.6% level.

The 38.2% level.

The 50% level – which isn’t a ‘true’ level but is still widely used.

And the 61.8% level.

These are the 4 levels we all know and that are always mentioned in books and talked about by price action guru’s.

But while these are the most well known levels, they’re not the only ones…

There is in fact another “secret” level that doesn’t appear on the tool and that isn’t even a part of the fibonacci sequence.

It’s name…. The 75% level.

You’ve probably never heard of the 75% level. And there’s a good reason for that…

It’s made up.

Wait, what?

Unlike the other retracement levels, the 75% level isn’t a ‘real’ fibonacci level, it’s one I made up and added to the tool myself.

But why would I do something like this?

The answer is to trade a setup that very few traders know about.

Lets take a look…

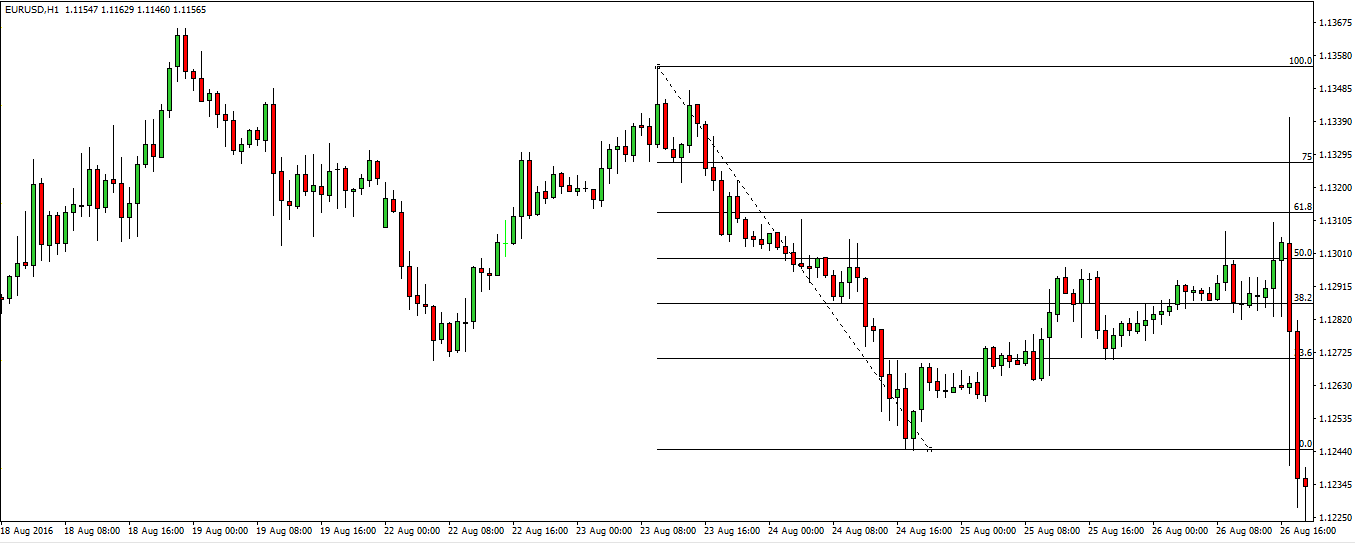

So here’s a retracement that took place on Eur/Usd.

Doesn’t look anything special, does it?

But don’t be fooled, because while this retracement probably looks similar to many you’ve seen before, it’s actually a special type that doesn’t appear very often…

Take a look at the retracement again.

Notice how it ends beyond the 61.8% level, close to the beginning of the swing?

This is called a deep retracement.

When the banks and other big players can’t get all their trades placed or profits taken at the price they want, they take/place what they can (which causes the price to rise/fall) and then manipulate the price so that it moves back near to the point where they placed or took their profits, in order to get the rest placed at roughly the same price.

The result of all this is a sharp rise or drop, followed by another sharp rise/drop in the other direction i.e a deep retracement.

What does all this have to do with the 75% level?

Because they’re created by the big players placing trades/taking profits, deep retracement usually appears just before large reversals, which means…

By identifying them (using the 75% level) you can get into some big reversal with very low risk.

Pretty cool, eh?

How To Trade The Deep Retracement Setup

Trading the deep retracement setup is quite easy. There are a couple of steps that might cause some issues, but for the most part, you shouldn’t have much trouble.

To trade the setup you must follow 5 steps:

1. Wait for a sharp upswing or downswing.

2. Place the retracement on the swing (and add the 75% level).

3. Enter a trade using a limit order or price action.

4. Place a stop below or above the swing.

5. Take profits as the price moves in your favor.

Let’s go through each step now…

Step 1: Wait For A Sharp Up-Swing Or Downswing

So the first, and probably most important step is to wait for a sharp upswing or downswing to take place.

Deep retracements appear on all type of swings.

However, the ones that usually result in a large reversal are typically sharp swings, swings made up mostly of large candlesticks with little to no candles of the opposite type forming.

Here’s what I mean by a “sharp rise”.

You can see that this rise consists mainly of large bullish candlesticks. There are some bearish candles, but they’re only small, and they don’t cause any kind of large decline to take place.

This is how a sharp decline should look.

Again, note how the decline is made up primarily of large bearish candlesticks (and a gap, in this case) with only a few bullish ones forming, none of which cause any sort of big rise to occur.

Step 2: Place The Fib Retracement On The Rise/Decline

While the deep retracement setup isn’t the same as a typical retracement entry, the way you place the Fib tool on the upswings and downswings is exactly the same:

For sharp upswings…

You place the tool at the low of the swing and then drag it up to the high.

Note: The tool is in the right place if the 100% level is on the low of the up-swing and the 0% level is at the top.

For sharp downswings…

You put the tool on the high of the swing and then drag it down to the low.

You put the tool on the high of the swing and then drag it down to the low.

Note: If placed correctly the 100% level will be on the high of the downswing and the 0% level will be on the low.

Now you need to add the 75% level to the tool, to see if a retracement is in fact ‘deep’ and to enter a trade (more on this in a minute).

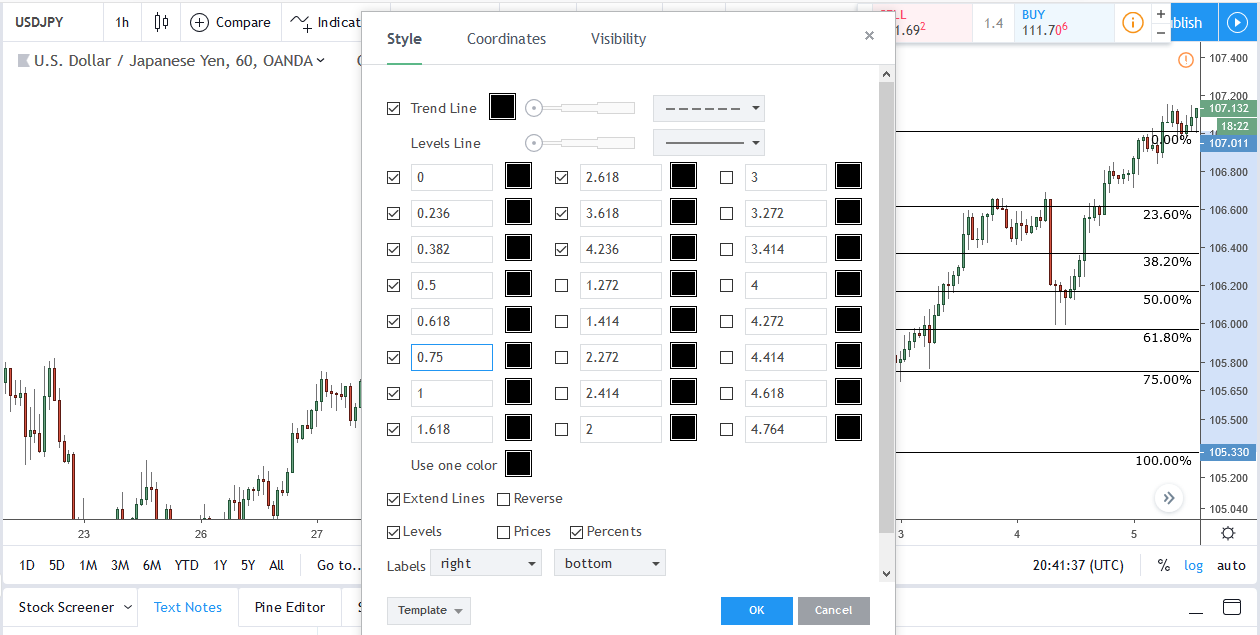

To add the level, right-click one of the lines and selecting “Settings”…

And then in the “Style” box change the 78.% retracement to 0.75%

The 75% level should now appear on the chart.

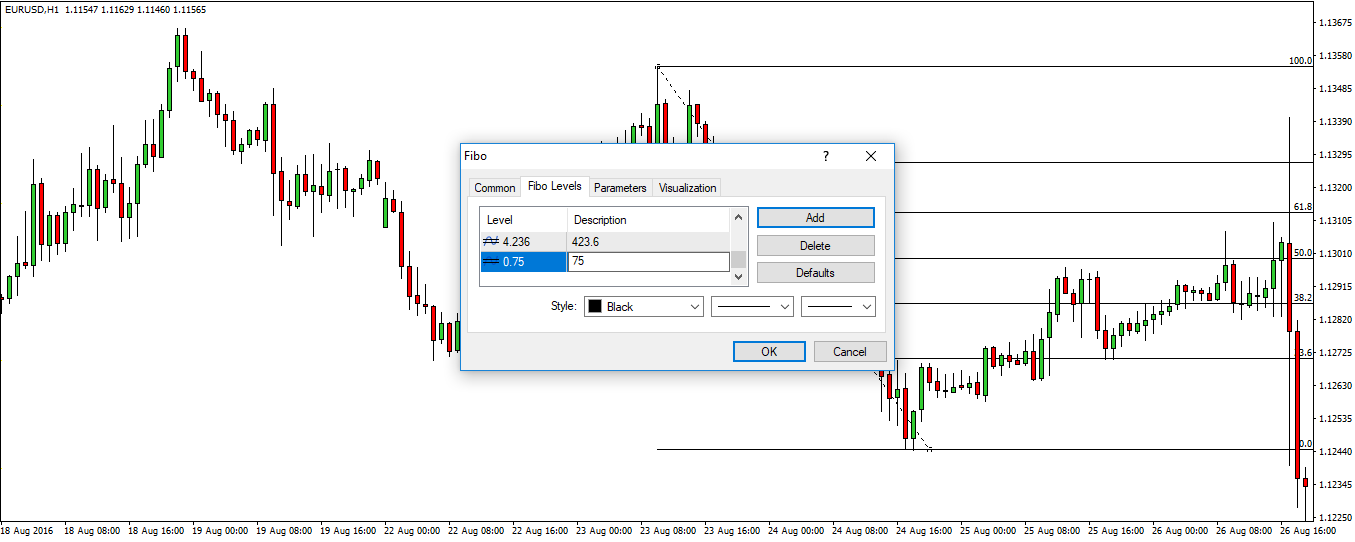

To add the level on MT4/5, right-click the Fib tool and select “Properties”…

When the menu pops up, click “Add”, enter 0.75 into the “Level” box and then double click to the right and enter 75 in the “Description” box.

The 75% level will now appear on the chart.

Step 3: Enter Using Price Action Or Limit Order

There are two ways you can trade the deep retracement setup, with each having its own pros and cons that’s suits different traders.

The first way is by using price action…

This is the type of entry to use if you want that extra little bit of confirmation a reversal is going to take place.

To use the price action entry, wait for the price to hit the 75% level and then enter once you see an engulfing pattern or pin bar candlestick form (bullish pin/engulf for upswings, bearish pin/engulf for downswings).

Whilst the price action entry is good for added confirmation, it comes at a cost…

Because a pattern won’t always form when the price hits the 75% level, you’ll sometimes miss out on successful trades.

The other way to enter is via limit/pending order…

The limit order entry is better suited for aggressive traders since it guarantees you get into a reversal whether a pattern forms or not.

To use it, simply place a limit order at the 75% level.

The main downside to using this type of entry is that sometimes a deep retracement won’t take place and the price will instead just break through the low (or high, in the case of downswings) of the swing, causing you to have a losing trade.

Step 4: Place A Stop Loss

Regardless of whether you decide to enter using price action or a limit order, the stop on your trade must always go either above or below the high or low of the swing.

For deep retracements on downswings, it needs to go just above the high.

For deep retracements on upswings, it must go below the low.

Note: It’s a good idea to leave a few pips gap between the low/high and your stop loss, to avoid any stop hunts that take place before the price reverses.

Step: 5: Take Profits As The Price Rises/Falls

Once you manage to get into a deep retracement trade, you need to move your stop to the end of the deep retracement swing and then keep moving it each time a new swing low or high appears.

Moving it to the end of the swing will reduce your risk dramatically, making it so that if the price reverses you only lose a very small amount.

Make sure you only move the stop to the end of the deep retracement swing AFTER the price has made it back to the halfway point of the previous swing.

You can check this by placing the fib tool on the swing and seeing if the price is at or above the 50% level.

Summary

The deep retracement setup is a great addition to any trading strategy. While it doesn’t appear that often it has a high probability of working out, and will allow you to get into some big reversal trades.