In today’s post, I’m going to show you how to use one of the most useful and important tools in all of price action:

Yes, I’m talking about the Fibonacci retracement tool.

The Fibonacci retracement tool (or fib tool as I call it), is designed to help you find when and where a retracement will end. It’s similar to support and resistance in that it marks levels where price could reverse during a retracement.

The key difference: it does this automatically, through the use of a tool, rather than you placing the levels manually.

So, here’s how the guide will go…

First, I’ll explain what the Fibonacci retracement tool is and how it works. The tool is fairly simple, so this shouldn’t take too long. After, I’ll show you how to place the levels on the chart correctly, as there’s a right and wrong way to place the tool you need to know before using it.

Finally, at the end, I’ll show you 3 effective ways to use the Fib tool in your trading.

As always, if you have any comments, be sure to leave them in the comment section at the bottom.

Let’s get into it.

Fibonacci Retracements In Trading

If there’s one thing that’s true about forex it’s that price never moves up or down in a straight line.

Most of the time price will advance, correct a certain distance, advance again, then correct a bit more before continuing to advance… and so and so forth.

This is the natural behaviour of the market.

Price is ‘breathing’, expanding and contracting as money from different parties flows in and out.

When price moves in one direction and then starts to correct (move in the opposite direction), it’s called a retracement, or pullback as some people know.

I’m sure you’ve heard of these before.

Retracements offer a low-risk way to get into an existing trend or strong movement. The fact price moves counter to the main direction gives you an opportunity to buy low and sell high (or sell high and buy low if you short), which we all know is the key to making money in trading.

The Fibonacci retracement tool allows you to gauge when and where these retracements may end.

Through the use of some complex calculations, which I won’t bother explaining here, the tool marks 5 horizontal lines on the chart.

These lines, which can be thought of as support and resistance levels but marked automatically rather than manually, show the points where a retracement has a high probability of ending.

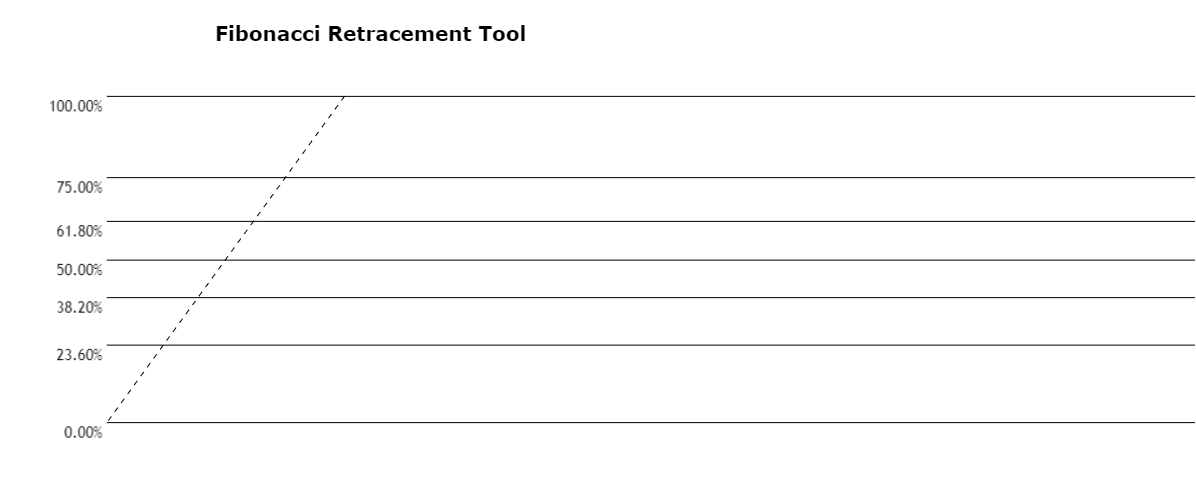

Here’s what the tool looks like:

As you can see, it’s just 7 horizontal lines – 5 if you count the 0 and 100 levels, which we don’t use in trading.

These lines are the retracement levels.

They’re the points the Fibonacci retracement tool has calculated where a retracement has a high probability of ending.

See how each level has a little percentage attached?

This shows how far price has retraced into the prior swing when it reaches that level.

The reason the percentages are a bit off e.g 38.20%, 61.80%, etc is because of the calculation the tool uses.

The Fib tool uses the Fibonacci number sequence – basically a complex maths calculation – to find the levels and mark them on the chart. It calculates the levels in numbers e.g 38.20% is 0.382 and then converts them into percentages to show how far price has retraced into the previous swing.

So that’s what the tool looks like, but how does it work?

Well, let me show you some examples…

Here’s the beginning of a retracement on Eur/Usd.

Normally, you might use support and resistance levels or, if you have a bit more experience, supply and demand zones to find where this retracement may end.

These methods work well; they often coincide with where retracements terminate.

The problem is, they’re not specifically made for finding the end of retracements. They’re techniques for predicting reversals applied to retracements.

As a result of this, they don’t work that well. They do often fall in line with where retracements end, as I said, but they don’t predict them very accurately or map out how they’ll develop.

The Fibonacci retracement tool, however, does do this.

The fact it’s created just for retracements – though it has other uses as well – means it much more accurate at predicting where they’ll end and how they’ll develop.

This is what the retracement looks like with the Fib tool marked.

See how the tool mapped out the fall?

When the retracement started, price fell for a while before finding support at the 23.60% level.

After stalling for a few hours, price then fell again before rising back to the source of the decline. Another, much bigger, drop followed until price hit the 38.20% level, at which point it reversed, and the retracement ended.

Let’s look at another one…

Here’s another retracement, this time on Aud/Usd.

Normally, we wouldn’t know where this retracement might end or how it could unfold. With the Fibonacci retracement tool, though, we have a good idea of both.

Here’s how it panned out:

Just like the other example, the Fib tool predicted how the retracement would develop and where it might end. We didn’t see price stall at any of the levels like in the previous example, but it did reverse at the 38.20% level, which the tool marked for us on the chart.

Which Retracement Level Is Price Going To Reverse At?

The Fibonacci retracement tool makes it easy to see where a retracement could end and how it might develop. What it doesn’t do, however, is tell you which level price will ultimately reverse at.

It’s not all bad, though…

Even though the tool can’t tell you which retracement level price will reverse at, there are times when it’s more likely to reverse at one level over the other.

For example:

A correction after a sharp price movement is much more likely to end at the 38.20% or 23.60% retracement levels than the others.

The reason why is because traders and investors set greater profit targets after a sharp movement, (due to the price covering a big distance in a short amount of time). This means they take less profit off their trades, which in turn, means price doesn’t correct as much during retracements.

For more gradual movements, the opposite is true.

Instead of being more likely to reverse at the upper levels (23.60% – 38.20%), price instead has a much higher chance of reversing at the lower levels (61.80% – 78.60%). This is because investors and traders take a lot more profit off their trades during gradual movements, causing much deeper retracements to take place.

Keep in mind:

Even though the price is more likely to reverse at these ratios under differing conditions, it’s not guaranteed.

There will still be times when price reverses at the lower levels after sharp movements, and times when it reverses at the upper levels after gradual movements.

These aren’t cold hard rules, more just guidelines.

Another point: When you see the price hit a retracement level, you can’t just assume it’s going to reverse and place a trade.

The levels, while they all have a high probability of causing price to reverse, aren’t guaranteed. You have to wait until the price has given a signal that confirms the correction is likely to be over before you enter.

How To Draw Fibonacci Retracements Correctly

So, now you know what the Fibonacci retracement tool looks like and have some idea of how to use it, it’s time for me to explain the most important part of this whole guide:

How to draw the retracement levels correctly.

Because the Fibonacci tool doesn’t mark the levels automatically, you have to manually place the tool yourself on the swing the retracement is taking place on.

For the most part, this is easy.

You find the swing, select the tool, and then place it on the chart.

However, there are a couple of important things you need to know to make sure the tool is placed correctly so that the levels show up in the right location.

- Identify the Swing High and Low: Fibonacci retracements are created by taking two extreme points (peak and trough) on a chart and dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 100%. Therefore, correctly identifying the swing high and swing low is the first step.

- Correct Direction: Remember that retracements measure potential pullbacks within a trend. So, in an uptrend, you draw the Fibonacci levels from the swing low to swing high. Conversely, in a downtrend, you draw from the swing high to swing low.

- Selecting Appropriate Timeframe: Just like other technical analysis tools, Fibonacci retracements can be applied on various timeframes. However, it’s often considered that retracement levels are more reliable when drawn on longer timeframes as they are based on larger price movements.

- Consolidation and Confluence: Pay special attention when a Fibonacci level coincides with other technical factors like supply and demand zones or major support/resistance levels. This confluence can provide more reliable trading signals.

- Not All Levels Are Equal: While all Fibonacci levels can act as potential support or resistance, typically the 38.2%, 50%, and 61.8% are considered the most significant in trading.

- Not a Guarantee: Lastly, it’s important to understand that while Fibonacci retracement levels can be a helpful tool, they are not foolproof. Prices may not always react as expected, so proper risk management strategies should always be used.

Here’s what you need to do:

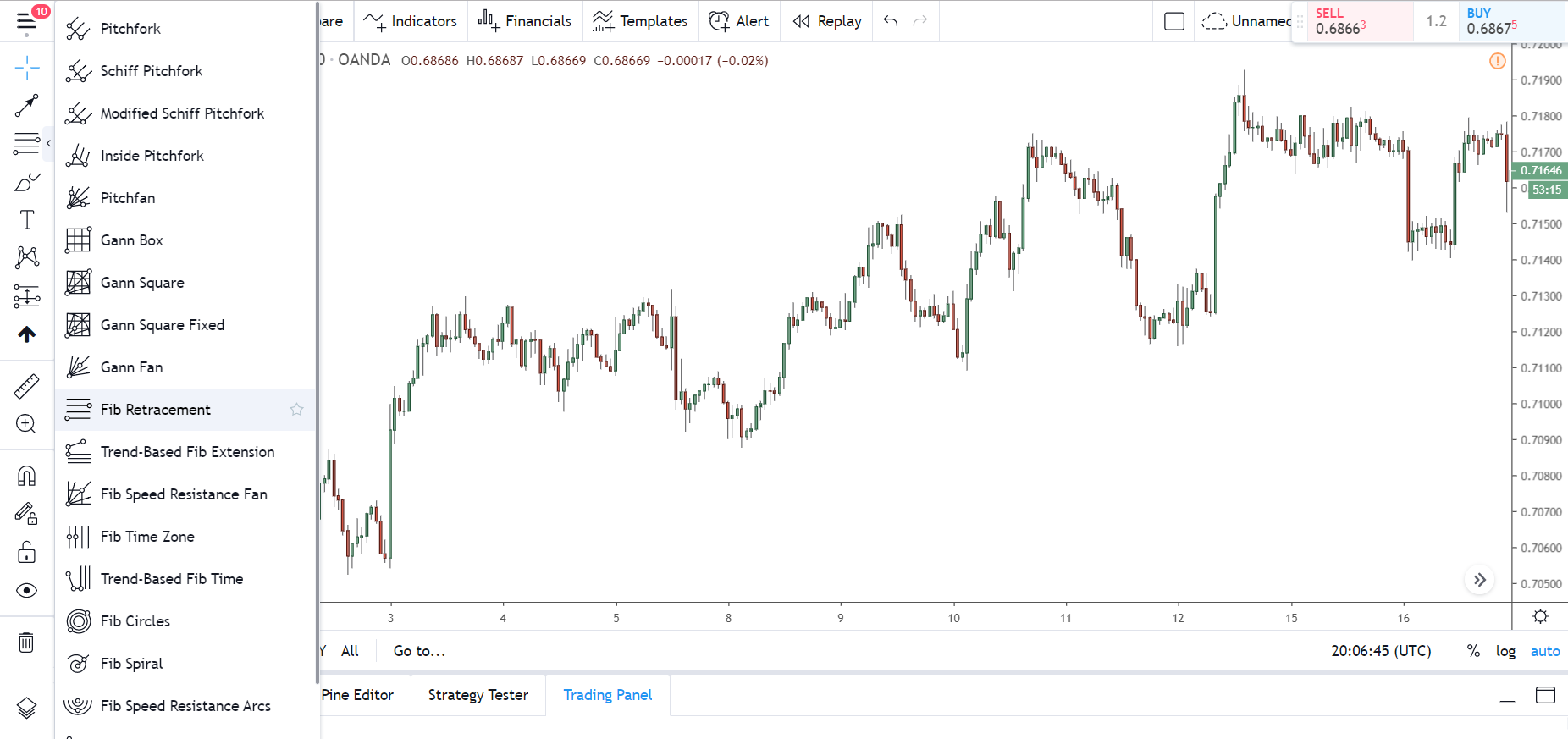

Step 1) Select The Fibonacci Retracement Tool

While you may not be familar, the Fibonacci retracement is one of the most popular tools in forex, which means it’s available on pretty much every trading or charting website out there.

Select the tool on Tradingview:

Open the Fibonacci Studies window (3rd Icon From Top)…

Now click “Fib Retracement” from the drop down list.

Step 2) Locate The Beginning And End Of The Current Price Swing

Okay, now here’s where things get a bit tricky…

The retracement tool calculates where the levels should appear using the prior price swing. So to mark the retracement levels correctly, you must find the beginning and end of the swing the retracement is taking place on.

A swing forms when price rises or falls for a while before moving in the opposite direction.

There are two types:

Upswings – Swings created when price rises for an extended period after previously falling.

Downswings – Swings created when price falls for an extended period after previously rising.

All price movement in forex is made up of upswings followed by downswings followed by upswings and vice versa.

This is obvious if I put a zig-zag indicator on the chart.

Now, to find where the current swing begins and ends, you must first locate the source of the swing and then the point where it ends, and the retracement begins.

Here’s how to do this for upswings:

Upswings

For upswings, the beginning of the swing is the point where the previous downswing (sustained decline) ended and price started rising.

In this case, the previous downswing ended where I’ve marked the outlined circle. The lowest low created at this point is the beginning of the upswing.

Finding the end of the up-swing is much easier.

Just locate the highest high created when the retracement started. The retracement itself is considered a downswing.

Now let’s look at placing the tool on downswings…

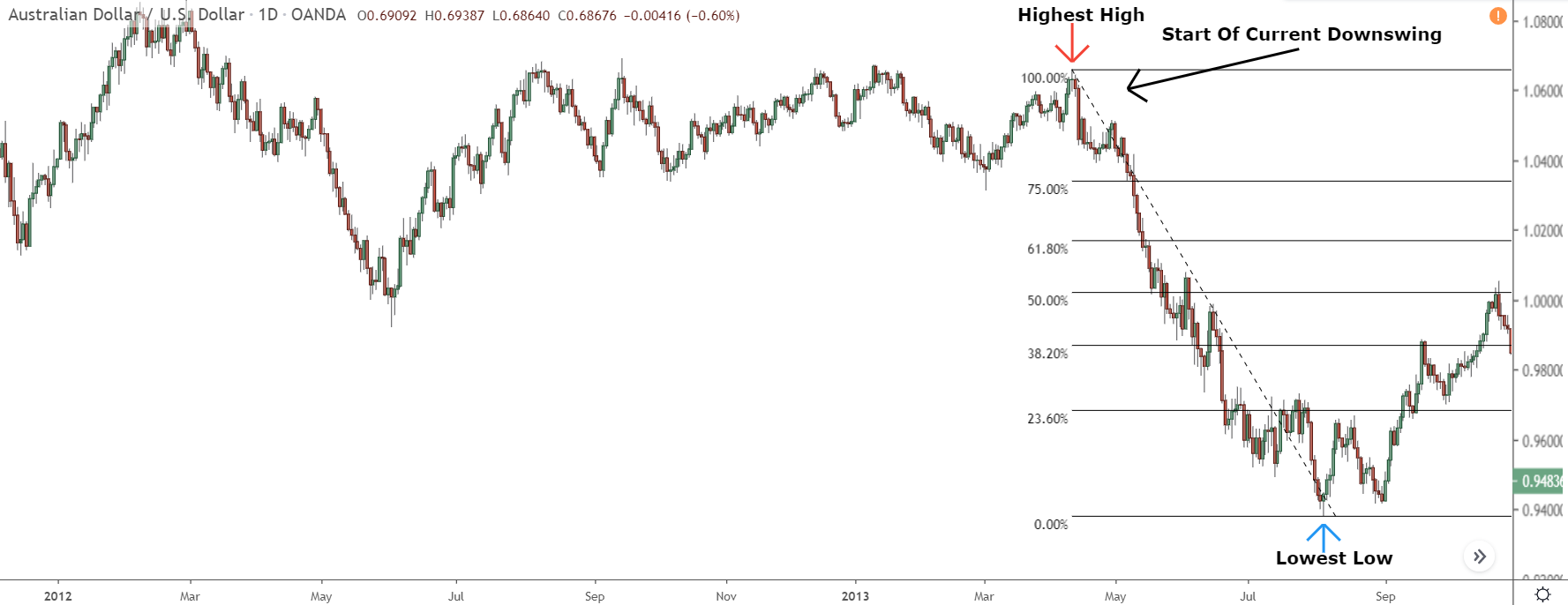

Downswings

For downswings, the beginning of the swing is the highest high created when the previous upswing ended and the downswing started.

To find the high, just look at where the last major upswing ended – again, major meaning a sustained price rise not just a couple of candles that caused a small retracement like at points 1, 2, and 3.

In our case, it’s the outlined circle.

Place the tool on the highest high found inside here.

Find the end of a downswing to locate the beginning of the retracement – the lowest low created by the new reversal is the start of an upswing.

Step 3) Drag The Tool From The Beginning Of The Swing To The End

So, you’ve found where the current swing begins and ends.

The next step: Place the Fibonacci retracement tool at the beginning of the swing and drag it either down or up (depending on the swing) to the end.

Easy, right?

There are a couple of nuances to it, however, so let’s do a quick walk-through now.

Upswings

First off, find the lowest low created at the beginning of the current upswing.

In our case, this is the low marked with an arrow.

Now, click and drag the tool up to the highest high created at the end of the swing. As you drag upwards, you’ll see the retracement levels appear next to the swing.

Excellent!

Now the Fibonacci tool is in place, you can keep a close eye on those levels to see where the retracement might run out of steam.

Let’s switch gears and explore downswings…

Downswings

So first, find the highest high that formed at the beginning of the downswing.

This is the high marked with an arrow in our case.

Next, place the tool on the high and drag down until it sits on the lowest low found at the end of the downswing.

With the tool placed, you can start watching the retracement levels for a reversal.

Pretty easy, huh?

3 Effective Ways To Use Retracements In Your Trading

The retracement tool is great for understanding where a retracement may end and how it’ll develop over time. But how is that useful in real trading situations?

Well, in a few ways actually…

For one, it makes it much easier to get low a risk entry into a strong trend or movement, which, of course, helps us make more money. On top of that, the tool is great for finding confluence with other technical points, like support and resistance levels and supply and demand zones, so it enhances existing strategies too.

I haven’t got time to detail all the ways you can use the tool today, but here’s 3 I think are most effective.

#1 To Get Into Strong Moves

Getting a low-risk entry into a trend or strong movement is not easy.

Price often moves so violently during these moves that either no entry appears or is over so fast it was impossible to get in. Retracements are one of the only times you can get into moves like these, and this is something the fib tool makes very easy.

Do you know how to trade support and resistance levels?

To trade support and resistance, you mark the levels on the chart, wait for price to return, and then see if an entry trigger, like a candlestick pattern, appears to get into a trade.

Well, get this…

You use the retracement tool to enter trades in the same way.

By waiting for price to return to each level and then seeing if a candlestick pattern or some other entry signal appears, you can get a low-risk high reward entry into a strong trend or movement.

A good example of this is seen below…

See how a large bearish Engulfing pattern appeared at the 50.00% level?

Just like trading supply and demand or support and resistance, this Engulf forming at a retracement level signals price might be about to reverse, therefore is a great signal to enter short.

What happens later?

Price reverses, causing the retracement to end and the prior trend to continue.

Candlestick patterns like Pins and Engulfs work best as entry signals at retracement levels, but sharp rises or declines away also work really well, and it’s always better to see if the levels have confluence with other technical tools to confirm price has a high probability of reversing.

Speaking of confluence…

#2 Confirming Other Technical Points Of Interest

Looking for confluence is one of the best ways to find where price will turn, and it’s something else the Fibonacci retracement tool also comes in really handy for.

Finding confluence with the tool is simple:

You mark whatever technical levels or points you want to find confluence for on the chart and then place the tool on the most recent swing, just as I’ve done in the image below.

If one of the levels lines up with a technical point as the 50% level does with this demand zone, it has confluence with it, which means price has a better chance of reversing if it reaches the zone.

Retracements almost always end at some kind of technical point, usually a support or resistance level or supply and demand zone. Often, multiple levels or zones will have formed during the prior swing, so the Fibonacci retracement tool will also help you find which of these price is most likely to reverse at.

#3 Predicting Where Swings Will End

The Fibonacci retracements tool’s main use is to map out and predict where and when retracements could end. That’s what it was designed for, and that’s how it’s best used. What a lot of traders don’t know, however, it that not only can the tool map out where retracements may end, but also normal swings.

Did you notice the 100% level in the previous image?

Take a look again…

Below the 100% level – which isn’t actually a level, just the point where price has retraced 100% of the swing – there’s the 123.60% level.

This isn’t a retracement level – obviously, because price can’t retrace more than 100% of a swing. Rather, it’s what’s known as a Fibonacci extension.

Extensions are Fib levels that go beyond the 100% level.

They function the same as retracement levels, only they’re used for mapping out how future swings may unfold rather than retracements. The levels also follow the same number sequence; 23.60%, 38.20%, 50%, etc… but they all have a 1 in front – so 23.60% is 123.60% – because they appear past 100% of the swing rather than inside.

You can use Fibonacci extensions in lots of ways, but they’re best used for understanding how future swing may develop and where they might end.

Take the image below, for example…

Price is rising again after a retracement caused it to fall.

By applying the Fibonacci extensions, we can get a sense of how this new upswing might develop and where it may end.

The extensions mapped out the new swing nicely.

The upswing created after the retracement continued until price reached the 123.60% level, where a new retracement began (black arrow). Price then rose to the 150.00% level (green arrow), and another, much deeper retracement started.

Eventually, that also came to an end, and price began rising again.

This rise stalled first at the 161.80% level, then the 200% level before finally ending at the 241.00% level, where price reversed, and the entire upswing came to an end.

Now, I haven’t got time today to detail how extensions work – they really need their own in-depth post to be explained correctly.

But I have got a couple of pointers in case you want to use them…

1. Extensions are always placed at the beginning and end of a swing, but the opposite way around. Rather than place the 0% level at the end of the swing, as you do with retracements, you instead place it at the beginning, with the 100% level taking its place.

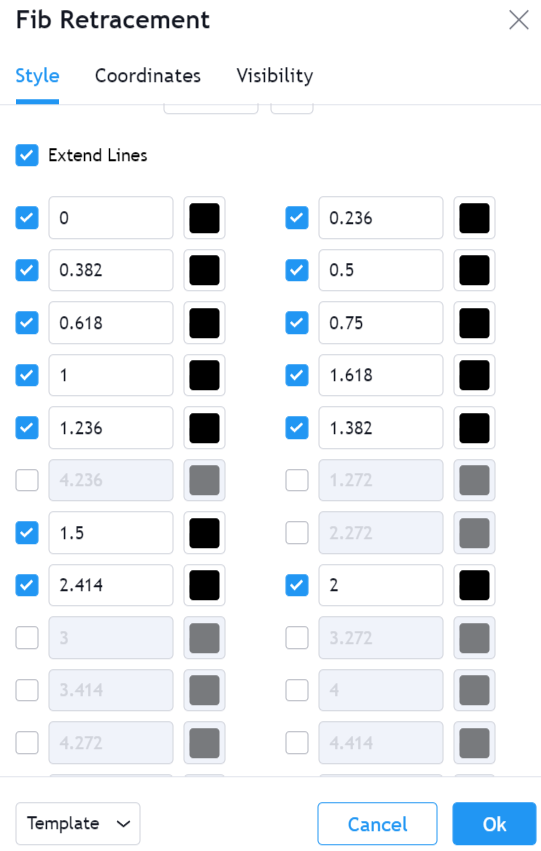

2. By default, the Fib tool doesn’t show extensions. It’s not a well known or well-used technique, so the tool won’t show the levels when you place it on the chart. To use the levels, you enter their values yourself through the settings menu of the fibonacci tool.

(This does differ depending on your charting platform!)

On Tradingview, just enter each number below 1 into a box.

Note: Right click one of the retracement levels and click settings to open up the menu below.

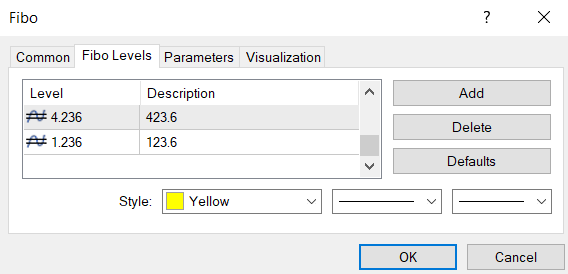

On MT4, open up the settings menu by right-clicking one of the retracement lines and selecting “Fibo Properties”.

When the menu opens, head over to the ‘Fibo Levels tab’ and click the ‘Add’ button.

Now, enter one of the levels in the level tab, and then put the corresponding percentage in the description box.

Repeat this until the following levels are entered.

1.236 – 123.6

1.382 – 138.2

1.5 – 150

1.618 – 161.8

2 – 200

2.414 – 241.4

And with that, the tool is ready to go.

Fibonacci Retracement FAQ: Your Questions Answered!

What is the best time frame to use Fibonacci retracement?

Fibonacci retracement can be used on any time frame or market, there is no ‘best’ timeframe.

Day traders will find it most helpful on a 15-minute or hourly chart. Swing traders, on the other hand, will find the levels helpful on the Daily or weekly charts.

It’s all about finding what works best for you.

What is the strongest Fibonacci retracement?

While all Fibonacci levels can be considered strong, the 61.8% level is known to be the most powerful followed by the 50% level. The other levels have varying levels of strength that depend largley on the market conditions at that time which created the upswing.

Is Fibonacci good for day trading?

Absolutely!

Fibonacci retracements can be a real asset in a day trader’s toolkit. Whether you’re identifying potential reversal points or setting stop-loss and take-profit levels, the retracement tool can help you out.

Just remember: always use the levels in combination with other analysis tools.

What is a 50% Fibonacci retracement level?

The 50% Fibonacci retracement level is where price retraces half of its initial move. It’s not technically part of the Fibonacci sequence, but traders have adopted it because price seems to respect the 50% level quite often during retracements.

The Bottom Line

So, there you have it – the Fibonacci retracement tool in all its glory. It might seem a bit complex at first glance, but trust me, it’s a game-changer. This tool helps you identify potential retracement reversal points and provides some level of confirmation, giving you a serious edge in the market.

It’s a must-have for any trader looking to learn the art of price action.

can you send this as a pdf much certified with your notes