There are many pieces of sage trading advice that have been passed down through the generatations, staying as true as ever even throughout market changes.

One of the most famous of these…

Losers average losers.

Heard this before?

The above quote has been making the rounds for decades now. But what does it actually mean, who came up with it, and how can you use it to improve your trading?

Stay tuned, because that’s exactly what we’re going to look at today.

Lets gets started…

What Does Losers Average Losers Mean?

The phrase “losers average losers” has a handful of interpretations floating around on the web, but let’s dive into the accurate meaning as per Paul Tudor Jones, the guy who coined the phrase.

“Losers average losers” essentially refers to the strategy of averaging down a position. This means trying to offset a losing trade by adding more trades in the same direction as the loss.

The theory here?

If price swings back in the direction you predicted, those additional trades will make up for the initial loss.

Let’s consider an example for clarity:

Imagine you’ve gone long in the image above and you’re currently holding a long trade open at a loss. Averaging down in this context would mean placing more long trades as the price drops.

- Position 1: Opened from the engulfing pattern.

- Position 2: Perhaps placed at a 50 pip loss.

- Position 3: Maybe placed 50 pips below Position 2.

And the process continues…

By the time the price reaches the point indicated below, instead of having just one trade open at a loss, you’re juggling three! Each trade is racking up double or even triple-digit losses.

Essentially, your single loss has now tripled in size.

Now do you see the danger lurking behind averaging down?

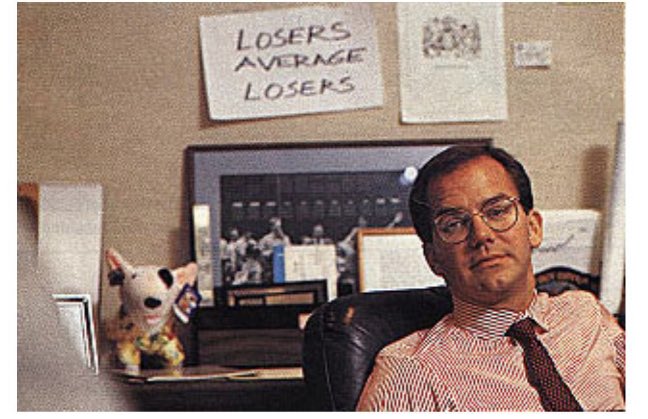

The catchy phrase “Losers average losers” was coined by Paul Tudor Jones in a trading documentary filmed back in the ’80s. One of Jones’ golden rules in trading is to never average down, which he aptly translates as “losers average losers.”

In his words, he contends:

“Only a loser would double down on a position that’s already taken a significant hit.”

Honestly, who can argue with that?

One of the main reasons this quote has become so iconic is that Jones literally has it pinned above his desk on a piece of paper. In a memorable moment during the film, the camera pans to Jones, and there it is, right above his desk – the now-famous quote in plain sight.

Here’s a screenshot:

Isn’t that just hilarious?

Paul keeps this quote front and center on his desk as a daily reminder to never, ever average down. He’s all too aware of how quickly this strategy can spiral into disaster.

Here’s a fun little tidbit for you: Paul Tudor Jones is notoriously not a fan of the documentary in which he is the star. In fact, he has gone to great lengths over the years to wipe all traces of the film from existence, even going to the extreme of buying up most retail copies just to toss them into a bonfire.

Talk about commitment, huh?

So, Paul, if you’re reading this, don’t come after me, okay?

Why You Should Never Average Down Your Losses (Examples)

There’s a very good reason why losers average losers has become such a well known trading mantra over years (hint, it’s not because who said it).

The real reason?

Averaging a losing trade is by far the most dangerous tactic in forex.

More trading accounts are blown due to people averaging down than anything else. It’s the one mistake almost impossible to come back from mainly because of the pschological effect averaging down has on ones mindset and actions.

To explain further, let’s walk through a typical averaging down example…

Example #1: Eur/Usd 1 Short Trade

Imagine you’ve just entered a pin bar trade, using the support level above as confluence. After a slight bounce, price decides to play hardball and dips below your entry price, landing you in the red.

No sweat, right?

Price is bound to bounce back any minute now… isn’t it?

Let’s take a closer look…

Of course, the market has a mind of its own, and price keeps tumbling down. Now you’re staring at a heavy loss – not exactly the outcome you had in mind!

So, what’s the game plan now?

For the average Joe trader, the knee-jerk reaction would be to close the trade – either manually or by letting the price hit a pre-set stop loss. Better to cut your losses early than to take a major hit, right? But hang on, we’re not talking about your average, run-of-the-mill traders here.

We’re shining a spotlight on the undisciplined traders.

The traders who CANNOT stomach a loss or admit when they’re wrong.

So, how do these traders react when they’re backed into a corner like this? They attempt to balance out their losses by entering more trades – i.e ‘averaging down’.

Here’s how it plays out:

Instead of biting the bullet and taking a minor loss, they double down and enter another long trade.

If price decides to climb again, it’ll eventually reach a point where the new trade can offset the loss inflicted by the first trade.

Sounds like a solid plan, right?

Key point to remember: ‘averaging down’ often goes hand in hand with ramping up the size of each subsequent position. It’s like doubling down in a game of poker or roulette. For instance, price only needs to travel half the distance for a 2 micro lot trade to recover the losses incurred by a 1 micro lot trade.

Of course, things rarely go as planned in this game…

Take a look at the image below…

Got a bit of a shock there, didn’t you?

After that tiny bounce, which kindled a flicker of hope, price nosedives and lo and behold, the downtrend is back with a vengeance.

Pretty brutal, huh?

So, you’re left staring at two open trades bleeding red:

- Trade 1, from 1.23400, is nursing a 150 pip loss.

- Trade 2, from 1.22500, isn’t faring much better with a 100 pip loss.

So what’s your next move?

You got it!

Plunge into another trade!

Here’s the catch-22 situation: Closing those two trades would mean swallowing a massive loss. Thus, the only option on the table is to dive into more trades, trying to dodge the bullet with a smaller loss.

Notice the shift in mindset compared to before?

Trade 2 was all about playing catch-up, making up for the losses of trade 1, and potentially turning a profit.

But now, trade 3 is all about damage control – it’s placed to trim the losses of trades 1 and 2, and hopefully, get out of the mess with a smaller loss.

Can you see why averaging down is a slippery slope?

The deeper the hole, the more desperate the trader becomes.

Instead of clawing back a small loss, the goalposts shift dramatically – now, it’s all about cutting losses and salvaging what’s left. The loss has snowballed to such an extent that the trader now just wants to soften the blow.

Here’s the grand finale…

Price drops like a rock after trade 3, cranking up the loss on all three trades, and putting your account seriously underwater.

At this point, one of two things can happen:

- 1. You finally decide close the trade due to the loss.

- 2. You enter more trades to continue averaging down.

What’s more likely?

In this case, scenario two.

Most traders who reach this point will continue averaging down, as they’ve lost so much money that finally closing at a loss (the right thing to do) will feel negliable. So, they continue averaging down until the market take them out and destorys their account.

Another trader bites the dust.

See the danger of averaging down now?

How even averaging down once traps traders into a catastrophic cyle of entering further positions to recoupe unchecked losses?

That’s the reason Paul Tudor Jones keeps losers average losers above his trading desk. He knows averging down once, just losing discipline one time, can put him on a destructive path to total account annalilation, losing all of his and his backers money.

The Key Takeaway: Always Set A Stop Loss

Ready to sidestep the disaster above?

Here’s the golden rule:

Set a stop loss with EACH AND EVERY trade.

No exceptions, no excuses!

Averaging down might seem tempting, but beware—it’s a one-way ticket to catastrophe.

Here’s the cold, hard truth: The market almost never returns to your entry point. Instead, your losses snowball, growing monstrous and out of control. And if you’ve been holding on for dear life, refusing to close and swallow a minor loss, guess what the grand finale is likely to be?

You’ve got it – a blown account.

Ouch!

A stop loss isn’t just your trusty sidekick in limiting losses.

It’s your reality check, your reminder to take responsibility for your actions and own up to your missteps.

No stop loss?

Then you’re living in a no-accountability zone.

You can’t own up to the consequences of your mistakes, and so will go above and beyhond refusing to accpet you’ve done anything wrong, inveitably leading to…

Yep you guessed it:

Averaging down.

So here it is again, louder for the folks in the back:

Always, ALWAYS set a stop loss with every trade.

Don’t average your losses, take responseability and accept them. Better to live to fight another day, then exit the game with your head in your hands.

Am it right, or am I right?

The Bottom Line

Alright, let’s wrap up this up.

In a nutshell, losers average losers is Wall Street’s way of telling us, “Hey, don’t throw good money after bad!” It’s a cautionary tale against adding to a losing position, hoping for a turnaround that might never come.

Averaging down isn’t a lifeline for a sinking ship.

It’s an anchor dragging you deeper into the abyss.

So, the next time you’re tempted to average down on a losing trade, just remember this nugget of trading wisdom.

Losers average losers, and we’re here to win, right?

Stay sharp, trade smart, and keep those profits rolling in!