Ready to have your mindblown?

Here’s a secret:

Forex is a zero-sum game, just like poker.

The only way to make money is via other traders losing. This profoundly shapes the forex market, dictating how traders profit, market strategies, and how prices move.

Every market nuance is, in one way or another, linked to this single fact.

So, it’s about time we delve deep into understanding this core concept.

In this post, we’ll dissect forex being a zero-sum game, and we’ll unravel the three significant implications of this has on the market.

These play a pivotal role in shaping the market, influencing everything from how the smart money turn a profit to why a trader’s focus should be less on technical analysis and more on deciphering the thought processes and decision-making of fellow traders.

So, ready to decode the zero-sum game of forex?

Let’s dive in!

The Basics of Zero Sum Game: What Does It Mean In Forex?

Surf the web, and you’ll stumble upon tons of definitions for zero-sum games.

Some are spot on, but most kind of miss the mark.

Here’s the real definition:

A zero-sum game is a situation in which the gains or losses of one party are exactly balanced by the losses or gains of the other party involved. This concept is often used in game theory. For example, in a game of poker, the combined amount of money remains constant (the ‘pot’), and one player’s winnings come directly from the other players’ losses.

In a zero-sum game, the total amount of profit available is fixed, and any gain by one participant must be balanced by a loss to another.

Got it?

Cool.

So, when you make a profit in forex, it doesn’t come from your broker…

Nope!

It comes from other traders’ pockets.

You figured the market would go one way, the losers bet on the opposite.

They goofed up, and so, their losses become your profit. How? Well, when they close, price moves the other way. The more traders who wind up lossing, the further price swings in your favor, and so the bigger your profit becomes.

(I’ll circle back to this point later)

Three main features exist in zero-sum games:

- #1. The only way to win (or profit) is from other traders losing.

- #2. The amount of profit available depends on how much people are willing to risk.

- #3. The main goal is to outsmart other players (not technically a rule, but I’m putting it in)

These three features can be found in all zero-sum games, no matter how different they appear on the surface.

Take poker, for example:

Poker is a zero-sum game: the only way to win is by making others lose.

Your mission: Outplay the competition and take their cash.

The total amount you can make is determined by: 1. How many players there are and 2. How much they’re willing to put into the game. More players = more moolah. Your goal is to guess what cards others have and call their bluff.

Nail that, and you’re the champ.

Swiping their cash and pocketing it.

The twist: Forex works the exact same way.

The only way to profit is by making other traders lose. While you can’t force that to happen – none of us can move the markets; our trades are just too small – there exists one group of traders who can…

The smart money.

Banks, hedge funds, and other big fish.

What’s this mean for us?

In a nutshell: Our key focus in forex should always be predicting and anticipating how other traders think and make decisions because the only way to profit is when others lose.

You got to wrap your head around…

- A: How the sheep (retail traders) trade.

- B: How the smart money (banks, hedge funds, etc.) trade.

You know those traders who always seem to lose money to the big guys?

I like to call ’em “sheep.”

To know when price might reverse, you must learn how these sheep are trading. When they all move in the same direction (like during trends), that’s when the smart money will step in, take price the other way, and make them lose.

For example:

If most retail traders (sheep) are long, you know a reversal could be close.

Why?

Because the smart money can’t profit when most traders are trading the same way; no one’s losing! The SM has to take the price the other way to make the sheep lose and generate a profit.

You can use this intel to take advantage and join forces with the SM.

Let’s cut to the chase here: you must learn how the smart money operate if you want to make consistent money in the forex market.

They move? Your move.

They score? You score.

They fold? You fold.

Does it make sense why forex being zero-sum is important now? It’s your roadmap to profits and it guides you in decoding the markets.

Your focus?

The mindset of other traders!

Because that’s where the dough is – in others’ losses.

Technical analysis and stuff?

It doesn’t hold much water unless you connect it to the decision-making process of traders, a step overlooked by 99% of traders. They’re in the dark about forex being zero-sum. And that’s why they flounder – they don’t even know the rules of the game!

3 Massive Implications of Forex Being a Zero Sum Game

Forex, being a zero-sum game, impacts practically every facet of the market. It influences price movements, trading strategies, and how different groups of traders turn a profit.

Don’t forget: Zero-sum applies to everyone!

Every trader, smart money included, must acknowledge this fundamental market truth.

So, let’s delve into the top three implications of forex being a zero-sum game on the market…

#1: The Smart Money MUST Cause Other Traders To Lose – They Have To!

Forex being zero sum affects everyone operating in the market.

Whether you’re a regular Joe or a big shot at a bank or hedge fund, everyone must abide by this law. The only way to make money is when someone else loses – no exceptions, no excuses!

For the smart money to profit in forex, they must make other traders lose money.

That’s the only way they can make money and generate gains themselves.

The more they want to make = the more traders who must lose.

This bring us to a key point:

The #1 goal of smart money traders: To inflict the maxiumum amount of pain on as many traders as possible. That’s the only way to force masses of traders to close at a loss and generate significant profits for the big players themselves.

Most price action in forex forms due the smart money manipulating retail traders (sheep).

The smart money causes these events on purpose to either trap masses of traders into losing or trading the opposite way to lose at a later date.

It’s alll manipulation and misdirection, my friends!

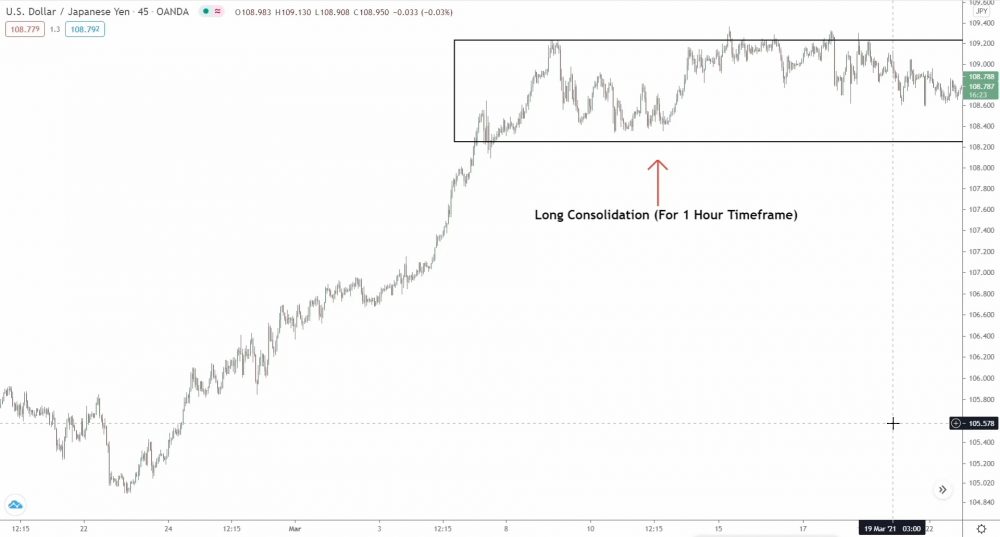

Take consolidations, for example….

For most traders, consolidations exist because the bulls and bears can’t decide on the future price direction, causing sideways price action.

However, that’s just what the books tell you.

Truth bomb: Consolidations serve a way more important purpose:

To shake traders out and get them to trade the other way.

When a consolidation forms after a long trending movement like you see above, what effect do you think that has on traders who got long during the last up-thrust (who are mostly the sheep with FOMO)?

Probably – that the up-move’s over, right?

Price has stopped rising; hence a reversal could be building.

So, what do most long traders do?

Close their long trades!

The consolidation has made them lose faith in the up-trend, so they either close or decide to jump in short. The longer the consolidation takes place, the more who close and jump in long. Both actions generate sell orders, which the smart money need to enter long trades.

Make sense?

These actions help the smart money generate profits; how?

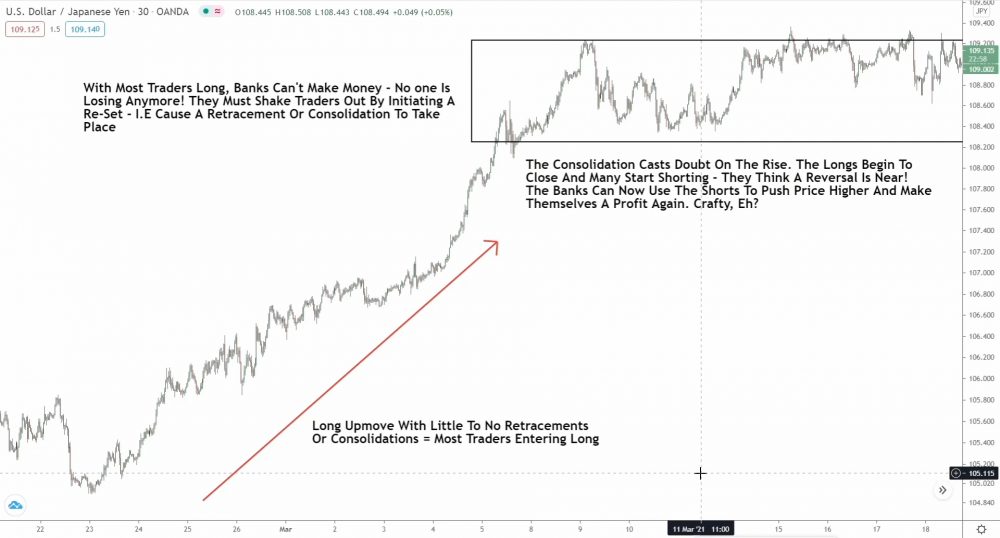

Because the longer price moves in the same direction, the more traders who trade the same way – enter long in our case.

For the smart money traders, that creates a big problem.

Remember: the only way to profit in a zero sum game is via other traders losing.

If price continues rising, most traders will enter long.

The smart money can’t make money; the sheep aren’t losing!

The smart money must get traders to exit their longs or trade the other way to mess up their view of the market and allow them to profit via taking price the other way.

Crafty, huh?

Just remember: Smart money traders are always on the lookout for the biggest group they can outwit and bamboozle for some easy cash. That’s why consolidations, retracements, and reversals exist – they mess with traders’ perceptions, giving smart money the chance to score big.

So, in our example….

Most traders were long due to how long price had been rising.

If price continued, the smart money would not make much money.

Only a few retail traders (sheep) are losing; most are long and making money!

To make money, the smart money must shake these traders traders out. How do they do that? By taking profits and causing a consolidation to form. The consolidation re-sets the sheep’s expectations and causes most reconsider the trend:

Price isn’t rising anymore; it’s moving sideways.

Price could breakout either way, which confuses traders.

Many decide to exit long and now enter short.

With the longs shaken and many now short, the smart money can profit again by pushing price higher.

When a new up-move begins, all the shorts exit at a loss, causing price to rise – because to close a short, you must buy back what you sold – and generating a profit for the smart money.

See how it works now; does that make sense?

Here’s the deal: Whenever a consolidation or retracement forms, the smart money want to manipulate the sheep. The SM create some chaos and get people to trade the other way, and then boom!

The smart money swoop in and make a killing by going in the opposite direction.

#2: The Only Way To Profit: Understand Where And When The Sheep Will Lose

Following on from the above…

Forex, being a zero-sum game, mean your gains come directly from another trader’s losses.

So, ditch the fixation on abstract concepts with little tangible impact, such as technical analysis, price action, and the like.

Here’s the crux of it all: Your primary focus should be pinpointing where and when massive chunks of traders are about to face losses and close out their trades. That’s because such scenarios trigger sizeable price movements and, voila, you’re in the green.

Pretty straightforward, isn’t it?

But here’s the kicker: As a retail trader, you don’t have the funds to move the market.

That’s a privilege exclusive to banks and other smart money traders who can manipulate price movements and force the average Joes to lose.

So, let’s get this straight:

Your profit hinges on these smart money traders.

But to predict when these traders will dive into the market and trigger losses, you need to know when and where retail traders will lose money.

Now, you might be scratching your head, wondering, “How on earth can I predict when masses of traders will face losses? Everyone’s got different strategies, right?”

Don’t sweat it; it’s not as daunting as it sounds.

You only need to grasp a few crucial insights about the herd mentality of traders. If you can decode how the herd trades, you can anticipate when and where most will jump in, and consequently, when the smart money will exploit them to their advantage—like cashing in on profits, for instance.

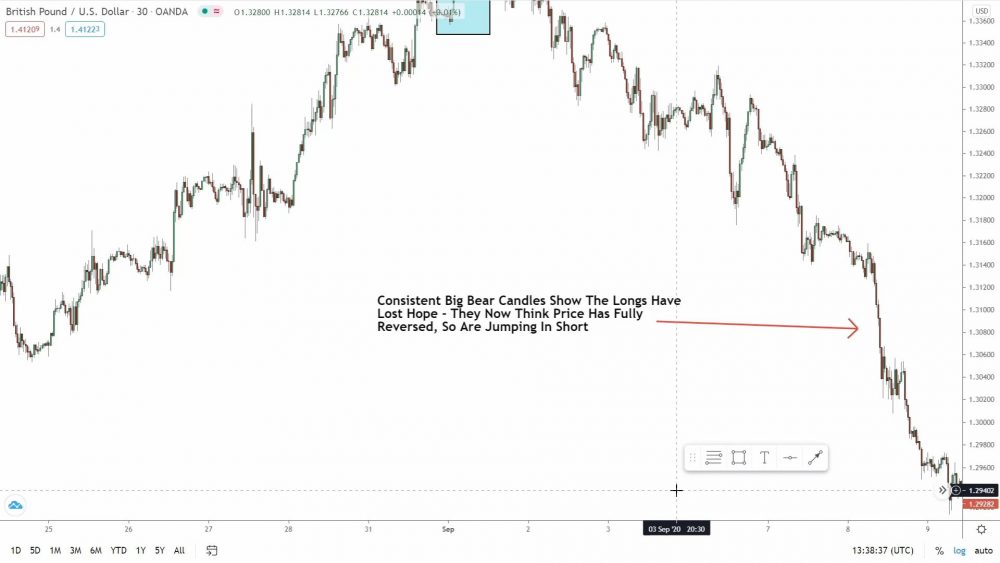

Let’s take a gander at this chart…

See how price has been falling for a while?

Sheep traders get super excited when they see prices shooting up or crashing down. They believe this means the trend will definitely continue. But, as you know, markets can be tricky, and that’s rarley the case. As such, they jump in en mass to capture the move.

And that causes a knock-on effect…

When these traders jump in, what happens?

What effect does thousands of sellers have on the market?

Price gathers momentum and continues falling!

Large bearish candles form, convincing even more sheep price is heading lower, causing more to get short. Our example shows a play-by-play breakdown of how this happens:

- First: The initial down-move begins, but most traders stay long due to the prior uptrend.

- Then: Price starts falling – the late longs start closing, causing more down-movement.

- Next: Price falls further, more longs close until big bear candles form one after the other.

Now, the longs who lost earlier believe price has reversed and a new downtrend is underway.

The longs from earlier enter short to capture what they assume is a continuation, generating massive selling pressure and causing price to fall further.

So, you now know lots and lots of traders are short.

Our understanding of how they trade tells us that.

But what does it mean for the smart money?

Well, like I explain later, one of the key facts in forex is buyers need sellers and vice versa, just like a real market.

- For the smart money to buy, the sheep must be selling.

- For the smart money to sell, the sheep must be buying.

The more the SM want to buy or sell, the more sheep who must be taking the opposite action.

With masses of sheep short, you know the smart money can now carry out actions that require thousands of sellers.

They can…

Take profits off sell trades –

You must buy back what you bought, which takes others selling.

Close existing sell trades –

Requires you to buy, so sellers must be present.

Or enter large buy trades –

Obviously requires masses of sellers – who else are you buying from?

Now, you don’t know which of these 3 actions will unfold. However, you know price can’t continue falling forever: because the longer price moves in the same direction, the more sheep who enter the same way, so the smart money can’t profit anymore.

SO: You should expect one of these actions to begin.

And what happens…

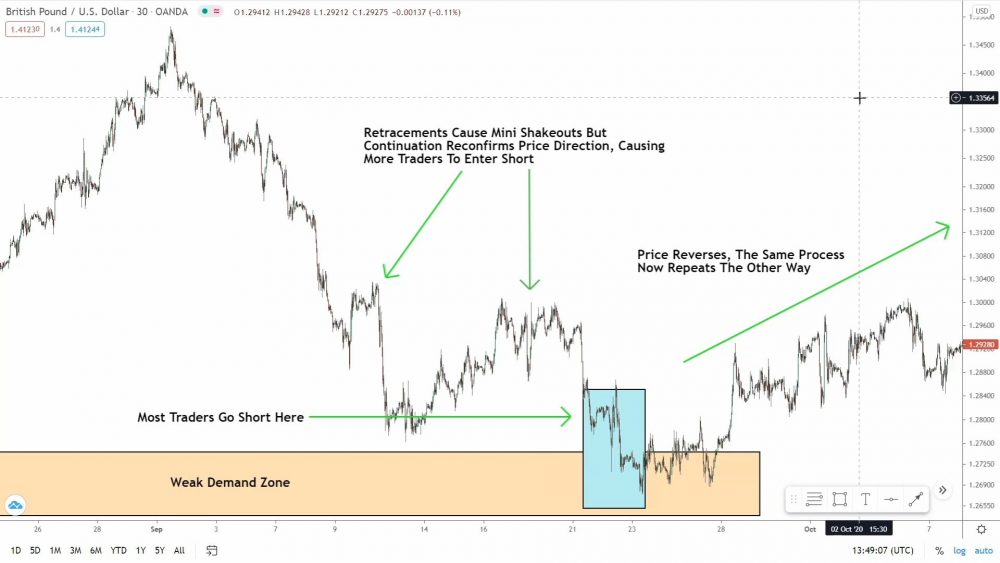

Those traders who were riding the uptrend are now going short, hoping to profit from prices falling. But wait! The selling pressure ramps up and the price tumbles.

Painful, isn’t it?

It’s clear a horde of traders are short, we knew that from their trading habits. But what about the big players, the smart money?

Here’s the deal:

In forex, it’s a give-and-take relationship – buyers need sellers and sellers need buyers. The smart money depends on the herd to execute trading action.

- If they’re buying, the herd must be selling.

- If they’re selling, the herd must be buying.

With the crowd going short, the smart money now has the opportunity to make moves that require a surplus of sellers. They can:

- Take profits off sell trades – They must buy back what they sold, necessitating more sellers.

- Close existing sell trades – To exit, they must buy, which means more sellers are needed.

- Initiate large buy trades – This requires a multitude of sellers to buy from.

Sure, you can’t predict exactly which of these three moves will play out. But you know the price isn’t going to fall indefinitely. The longer it falls, the more the herd swells, and the less profitable it becomes for the smart money.

So, what’s the game plan?

Prepare for one of those actions to launch.

Then, just sit back, relax, and enjoy the show…

After falling further, price reverses, and a new up move begins.

Where does the reversal begin?

Yep, you guessed it…

A weak rally-base-rally demand zone!

See how this all comes together now?

From a small understanding of how the sheep think and trade, you knew most were short. You also knew the smart money could now take one of 3 actions – thousands of sellers were free! You also knew price couldn’t keep falling forever:

At some point, price had to reverse so the smart money could profit again.

The most likely place for that to happen?

The demand zone, of course!

These concepts helped us better understand the market environment and anticipate what actions the smart money and sheep would take in response to one another.

Just another lightbulb moment you get from forex being a zero sum game.

#3: Losing Traders Closing Causes Major Price Movement

Ask any trader or guru what causes price to rise and fall, and I can almost guarantee they’ll say: Buying or selling.

Is this true? Yes…

But is it the full story?

Not quite…

See, while buying and selling causes price to rise and fall (obviously), most forget that market consist of multiple trader groups, who can all buy or sell at different times. Additionally, buying and selling doesn’t just come from placing trades.

In reality, every action in trading requires buying and selling.

For instance, when you’re taking profits from a sell trade, what you’re actually doing is buying back some of what you sold.

Closing a long trade that’s not doing so hot?

Yep, that’s selling what you bought.

But the real meat and potatoes of price movement – the thing you really need to keep your eyes on – is traders closing losing trades.

Here’s a truth bomb for you:

A major chunk of the price movement in forex doesn’t come from traders placing trades – which is what most people think – but from traders closing their losing trades.

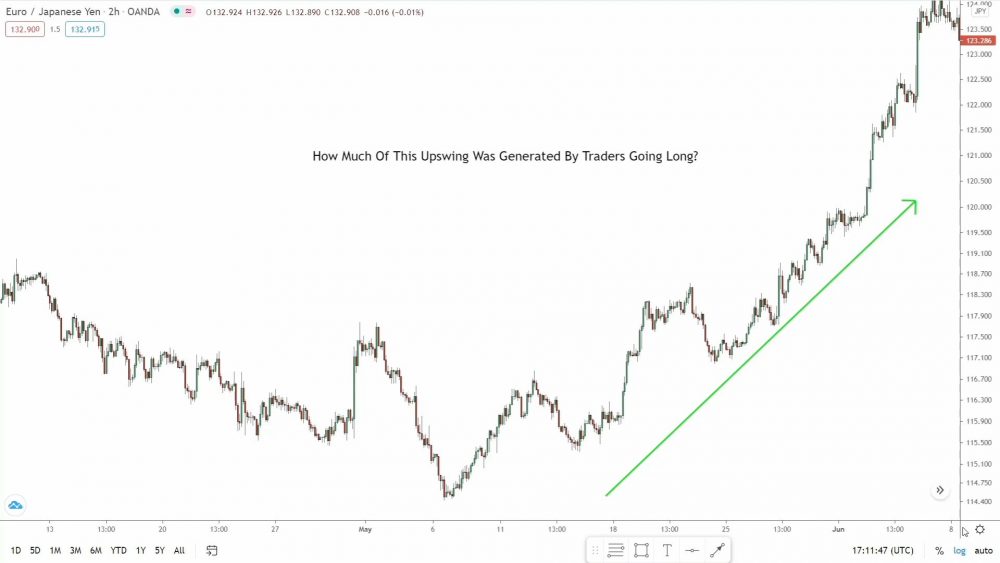

Take a look at this rise…

How much of this swing was created by traders closing losing shorts?

30%? 40%? 60%?

The answer: More than half – well over 50%!

Most of the up-swing above formed due to traders who went short during the previous downtrend closing losing sell trades at a loss. That’s what pushed price higher and generated most of the movement.

Remember: Closing a losing trade requires you to take the opposite action.

- To close a losing buy – you must SELL what you bought at a worse price.

- To close a losing sell – you must BUY back what you bought at a worse price.

Now, why is this?

Why is most of this rise generated from traders closing losing trades? And how do I know for sure that’s what created the rise and not something else?

The answer: Understanding our new friends – the “sheep”!

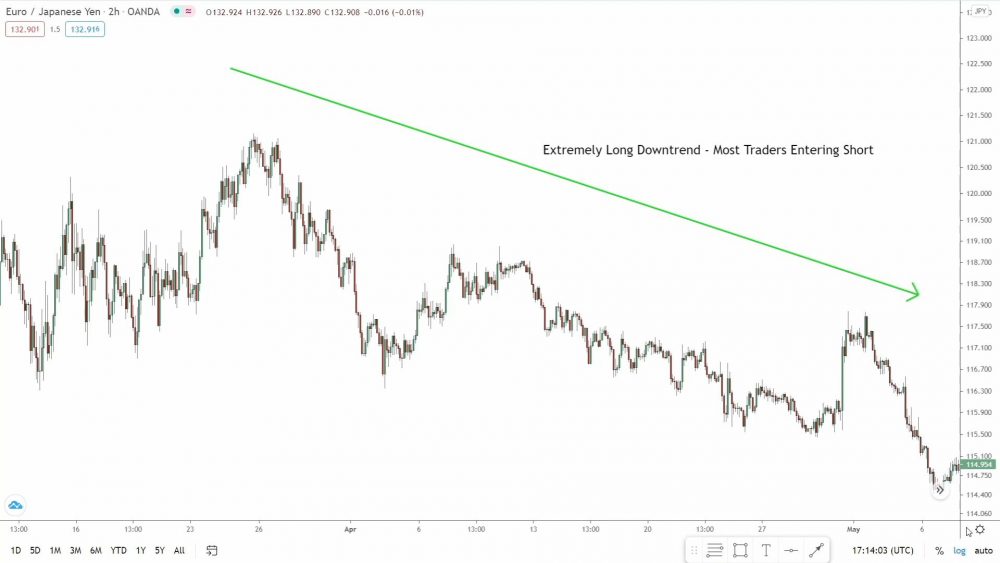

Take a peek at this downtrend on Eur/Jpy.

Seems pretty bearish, doesn’t it?

Price had been falling for about a month before the upswing caused a retracement. It’s a safe bet a lot of traders are entering short at the moment.

Why wouldn’t they?

Price has been in free fall for over a month!

The tried-and-true concept of trend-following tells us that when price rises or falls for a sustained amount of time, it’s likely to continue in the same direction. So, it’s clear that a lot of traders are entering short due to this long decline we’re seeing.

Now, let’s shake things up a bit…

Imagine if price suddenly skyrockets.

What happens to these short traders?

If you started shorting during the last drop (where most of the herd likely entered, hence the giant bearish candle), how would you react to a sudden price increase?

Unless you’re rocking nerves of steel, it’d be a bit nerve-wracking, right?

Price could be on the cusp of a reversal; so your money might be on the line.

And let’s be real, nobody’s a fan of losing money.

Now, let’s see what comes next…

So now the price has gone up a bit…

What do you think those shorts are up to now?

Are they hanging on or closing those losing trades?

Bingo: CLOSING!!

The sheep are scrambling to close because of the price rise. And hey, how do you close a losing short trade? Remember from earlier?

Yep, that’s right…

You must BUY back what you sold.

You buy back what you sold at a worse price, and that’s why you lose.

So, imagine thousands of traders closing their losing short positions. What’s going on? They’re actually all buying— they must buy back what they sold, duh!

Now, picture a whole buncha traders buying all at once.

Whad happens to the price?

It SURGES!

Loads of buy orders pour in.

Buying pressure skyrockets, causing a sharp rise.

But wait!

Not everyone went short during the last dip… loads of traders are still short from higher up in the prior downtrend. And some traders won’t close anyway—many will assume the rise is just a retracement, and price will drop again soon.

However, the higher price goes, the more sheep who realize a new uptrend is underway. And the more who decide to close, adding even more pressure to the upside.

It’s like a domino effect…

Price goes up a smidge, a few shorts close.

With extra buy pressure, price pushes higher.

Price moving higher now makes even more prior shorts want to close.

That ramps up the upside pressure, pushing price even higher!

This crazy cause-and-effect process continues until most shorts—except for a stubborn few—have closed their trades at a loss. Price has now moved so far against these traders they don’t think the downtrend has any chance of continuing.

So, now they jump on the bandwagon and go long.

Take a gander at the chart again…

Once price reaches the midpoint, most shorts have closed and are looking to enter long; price has risen enough for them to believe a new uptrend exists.

When they enter, price rises.

Then, once everyone is long and the smart money can’t extract more profit, they take profits of their own longs, causing price to reverse.

A large retracement then begins, which causes the late longs to lose, and allows the banks to buy again at more favourable prices.

What you see here is price movement 101.

The above explains how and why price rises/falls at the fundamental level. It’s not just buyers and sellers, like everyone assumes. It’s a combination of trader groups that together force each other into making different actions.

Make sense, now?

It doesn’t quite work like this in Forex. 99.99% of retail trades never see the light of day in the real Forex market. Brokers bucket orders and only trade the 1-5% of traders that make consistent money with large accounts. It’s cheaper for brokers to literally just pay out everyone else from their own pocket. Effectively, when you win you’re just taking profits from brokers which are earned in many forms and when you lose you’re making the broker money. It’s not a 1-1 system like many think in the actual Forex market for retail traders. There are even examples online of 1 million dollar trades being bucketed by brokers in Forex.